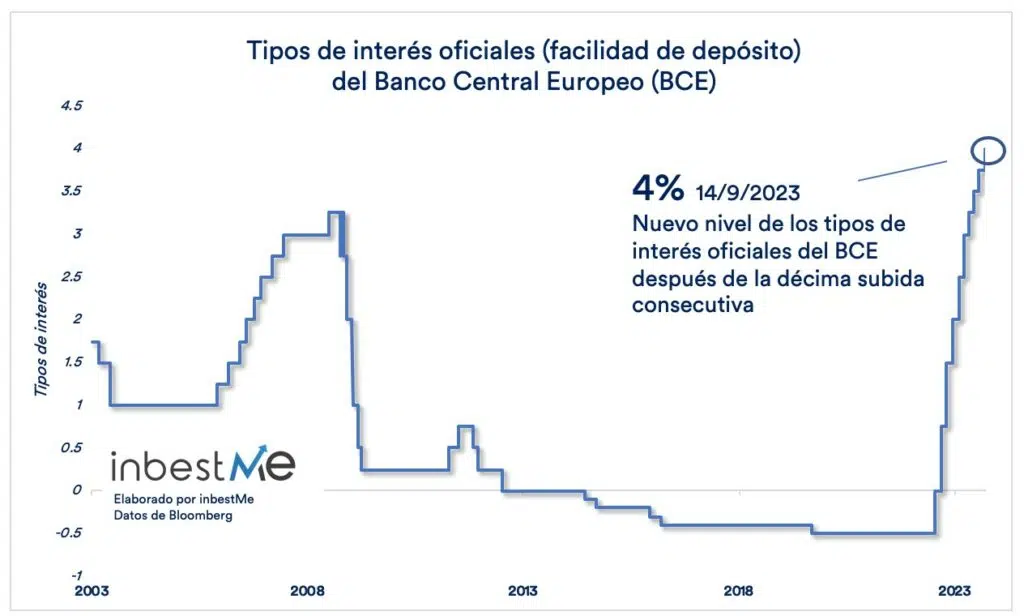

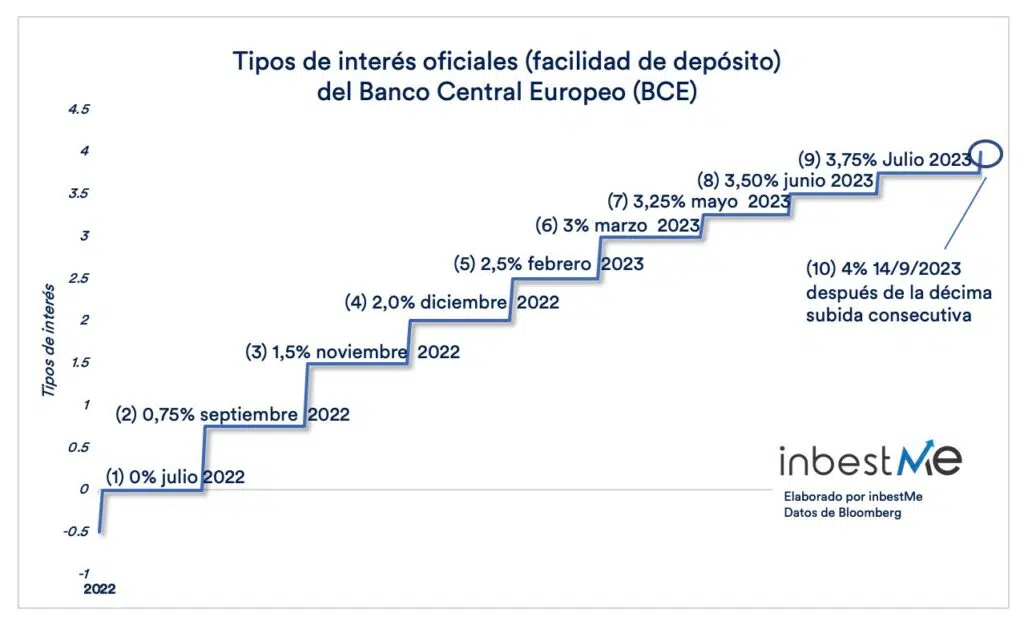

At its September 2023 meeting, the European Central Bank (ECB) decided to raise interest rates again by another 0.25%. The official interest rate (deposit facility or interest rate at which banks can make demand deposits with the central bank) was increased to 4%.

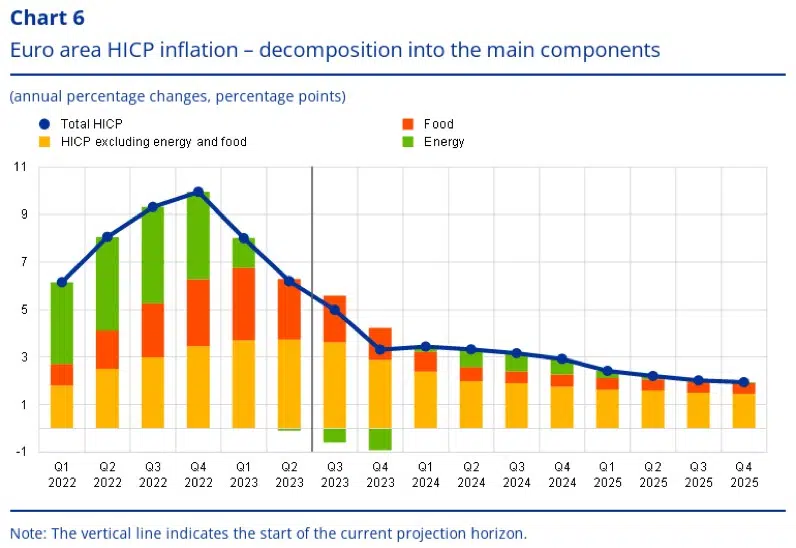

The increase is due to the fact that although inflation has decreased, it is still expected to remain high for longer than expected.

It is the tenth consecutive increase as we see in the following graph since the increase cycle began in July 2022.

The projections of ECB experts continue to place inflation at 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025 (see graph below).

Economic growth forecasts were revised downwards, but the ECB’s only objective is price stability.

Christine Lagarde left the door open for further increases if necessary, but the ECB’s statement was interpreted by investors in the direction that we have probably reached the ceiling of interest rates, at least for now. Specifically, the following phrase was interpreted as a sign of the end of the increases:

On the basis of its current assessment, the Governing Council considers that the ECB’s official interest rates have reached levels which, maintained for a sufficiently long period, will contribute substantially to returning inflation to the target in due course.

Furthermore, it appears that the decision was not unanimous. This means that, with a stagnant European economy, it will be more difficult in the future to find agreement to raise rates further.

Esta nueva subida tiene dos consecuencias.

The Yield of the Savings Portfolio in Euros will increase by 0.25% to 3.50%

Let us remember that the Savings Portfolio was designed to benefit from the expected increases in central bank interest rates.

Although the announcement of the increase was made on September 14, this increase will be effective from 9/20/2023 and the monetary funds will begin to collect the new rates a few days later.

In line with the increase in interest rates by the ECB we can anticipate that the (variable) Yield of our savings portfolios will increase by 0.25% to 3.5% net at the beginning of October.

As always we will make the relevant communication when this happens.

Additional opportunity for 100% bond portfolios

Given that we are probably close to seeing the end of the rate increases, we have decided to relaunch and expand the offer (SRI version) of the 100% fixed income portfolios (Profile 0).

The distribution of the 100% fixed income portfolios (profile 0 of inbestMe’s “investment portfolios”) has been reviewed to:

- Maintain the security and simplicity features that have made the inbestMe Savings Wallet a great success (thousands of clients have hired it in recent months).

- But on the other hand, the investment horizon is slightly lengthened with respect to the savings portfolio (and implicitly volatility and risk)

In other words, Savings Portfolios are excellent portfolios in a scenario of rising interest rates. Let us remember that the Savings Portfolio is made up of monetary funds with practically no duration, and where, contrary to conventional bonds, the prices of these and therefore of the savings portfolios do not fall with the rise in rates. In fact, the other way around, when this happens they continue to accumulate profitability but at a faster rate.

Now we believe that interest rate increases are near the end and very conservative investors can consider portfolios with a certain duration, even if it is very short.

So now, in addition to our savings portfolios, which are still perfect for conservative investors or to maintain a risk-free emergency fund, our 100% bond portfolio is a great additional option when we know that the investment horizon is at least 2 years or more.

The distribution has been revised and is now more conservative (less duration) but some short-term bonuses have also been added. This allows investors:

• fix interest rates (now higher) for a longer period,

• obtain a certain increase in performance compared to the savings portfolio (especially when the IRR of this begins to decrease and the yield curves normalize)

• make a profit in case interest rates start to fall in the future.

The duration of the bonds, which is associated with the risk of bonds falling when interest rates rise (due to the inverse relationship), remains very short, below 1.5 years. Just for comparison, the duration of the Bloomberg Global Aggregate Index, which is the benchmark for global bond markets, is around 6.7 years (a duration more than 5 years longer).

Therefore, for that part of the assets (beyond the emergency fund) where our horizon is somewhat longer and we can slightly increase the risk (we will have to accept more volatility), the bond portfolio can be complementary.

You can see more information about the Bond portfolios.

You can see more information about the SRI bonds and green bonds portfolios.

On the other hand, in the medium and long term it still makes sense to invest in equities to clearly beat inflation.

To know what is best for you, you can know your risk profile based on your financial objectives, horizon and personal situation.