inbestMe’s objectives are fully aligned with our clients: to help them make their money grow as much as possible.

The launch of the inbestMe Savings Portfolio goes in this direction, complementing our current services.

In this link, you can consult the updated yield of the Savings Portfolios.

The Savings Portfolio is a different account from the savings accounts or deposits that you can find in traditional banks. It is not a traditional deposit. It is a securities account aimed at maintaining your savings and making them grow to the extent that interest rates on money allow. By not being tied to the commercial policies of a bank, we have the opportunity to offer you in your Savings Portfolio the closest annualized return to official money rates., whether in Euros or Dollars.

That means that, on the one hand, you may find more attractive interest on deposits, if a bank has an aggressive policy to accelerate the capture of deposits and customers. But it is very likely that the yield of our Savings Portfolio is always very close to the best options.

This is because the Savings Portfolio’s yield is variable, it adapts to the movements of the official rates of the central banks in Europe or the USA, which is why we define it as a variable yield.

And that is so automatically. In other words, you will not have to hunt for the best deposit, you will always have one of the best types automatically. Our interest rate in the Savings Portfolio is not a promotion and is not linked to any type of condition, bringing your payroll, taking out insurance, a mortgage or buying a television. Of course, we will not give you any iron, or saucepan, or other probably unnecessary utensil for your kitchen.

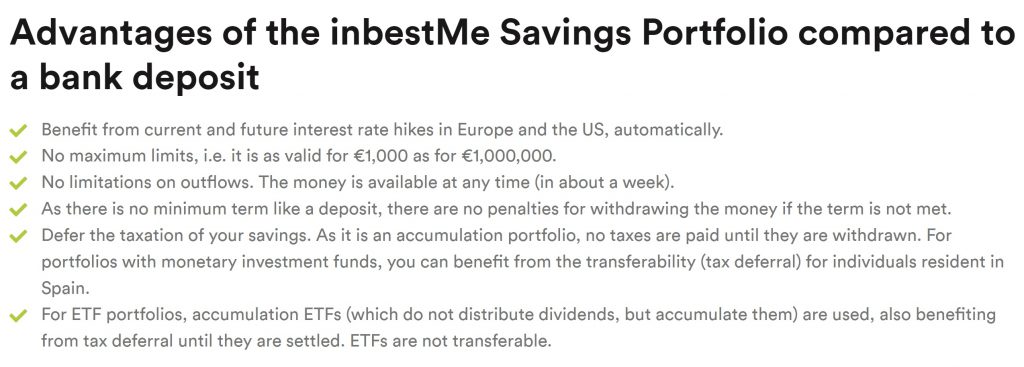

In addition, you will probably value all these other advantages:

Important note: The variable yield that we publish at all times is already net of any cost or commission that the Savings Portfolio supports. More in detail:

- The inbestMe management fee (0.12% to 0.25%),

- Trading or deposit (0.06% to 0.105%)

- And the implicit cost of monetary funds (0.10%). The range varies depending on the volume of the portfolio.

Table of contents

ToggleWhy is the yield variable?

Being a variable yield, this means that the yield is not guaranteed over time. In other words, it would be guaranteed if the official rates did not vary in the next year from the moment we published it.

But since, by design, this portfolio is linked to investment funds or money market ETFS that replicate official interest rates, if these vary, as is expected in the coming months (upwards in this case), the Savings Portfolio’s yield will vary (go up). If the scenario of rising rates changes downwards, the variable yield will at some point go down. If interest rates become negative again, for most investors, it would not be interesting to keep the Savings Portfolio. For some, even if they are negative, it may be interesting to keep it in order to “park” latent tax capital gains.

Actually, this has been like this almost all my life as long as the guys have been positive. No matter where you bank, the interest rate environment will always impact your financial life in some way. An example that almost everyone knows is mortgages with variable interest rates.

The interest rates that banks are willing to pay on deposits are intrinsically linked to either the European Central Bank for the Euro or the Federal Reserve for the Dollar, which set the interest rates at which banks can lend money to each other. This is known as the interbank rates.

To understand this in a little more detail, you can review how official and bank interest rates are set in Europe or in the US.

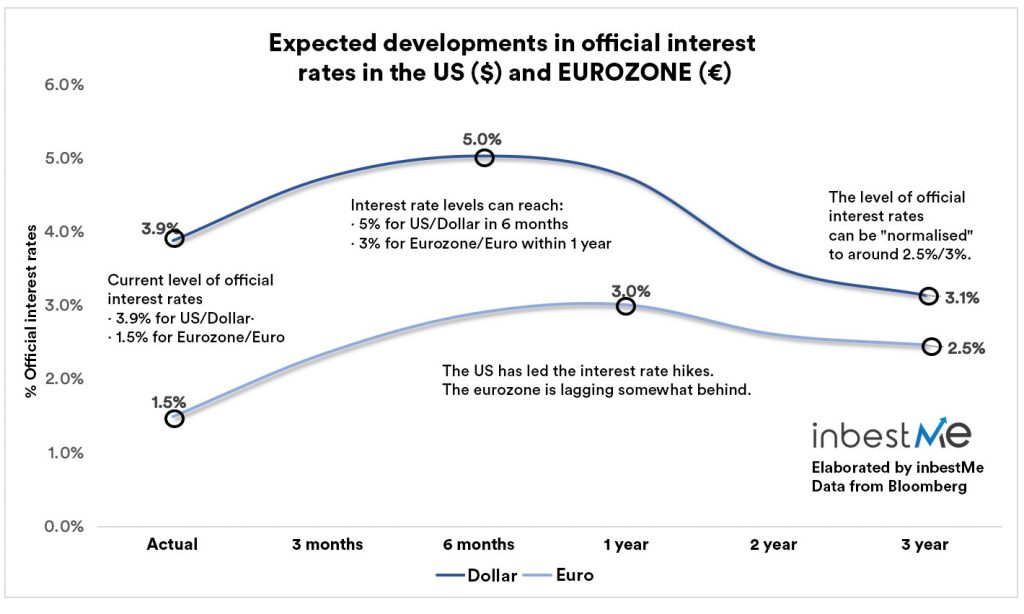

As the Savings Portfolio is made up of money market funds or ETFs linked to interbank interest rates, which are in turn linked to official rates, the yield may vary according to monetary policy. In the coming months, it is expected to rise as long as central banks apply restrictive policies, then stabilize and then fall or normalize.

It is likely that the zero interest policy is over, and official rates will trend positive again. Although only time will tell. To the extent that this is the case, the Savings Portfolio is a good complement to a good and healthy investment by objectives.

Expected return, volatility, yield and floating yield

The Savings Portfolio is also different from our other investment accounts. In our investment portfolios, whether index funds, pension plans or ETFs, we show the long-term expected return of each portfolio. This expected return is ultimately a statistical expectation of what the selected portfolio will obtain, on average, over the years, but as it is subject to the intrinsic volatility of any investment, by definition each year we will obtain a different return, and this difference may be more or less pronounced depending on the expected volatility of the portfolio, and more particularly on how the markets behave in shorter periods.

The Savings Portfolio, although strictly speaking it is an investment portfolio, due to the assets that compose it, investment funds or ETFs, has a volatility close to 0% and, therefore, it is easy to determine the annualized return or yield under certain rate circumstances. In other words, its expected return, it’s a priori annualized return, is easily determined in relation to the situation of official central bank rates.

If you understand this, you will also understand why it is variable. If the official central bank rates vary, the expected yield will also vary almost automatically and will be passed on to your account.

In an environment where central bank rates are on the rise, having a Savings Portfolio like the one proposed by inbestMe is probably a very efficient way to optimize your savings, as those increases will almost automatically translate into a better return. Just as in a falling interest rate environment, it is better to have a mortgage with variable (rather than fixed) interest rates in order to pay less interest.

Example of the effect of a variable yield

To illustrate in more detail how this is reflected in practice, we will use examples, which with a high degree of probability may occur in the next 3 years, according to expectations of the evolution of official interest rates. See indicative chart above or appendix.

Note: this is a simple simulation based on interest rate expectations and is not a commitment that the simulated average yield will be obtained.

The table above shows what would be a possible outcome of an investor who decides to deposit from 1/12/2022 €100,000 of his savings with an initial variable yield of 1.05%. In the interest rate columns, we simulate a possible evolution of official interest rates for different periods and what is the new variable yield for each period. In the simulated example we reflect a 0.75% increase at the beginning of 2023, another increase in the middle of 2023 and a 0.25% reduction from the end of 2024.

As a consequence of these variations, in our simulation, we observe how the variable yield has a period of increases from 1.05% to 1.80% until it reaches 2.55% and then falls to 2.30%.

This simulation remains a mere possibility. Although it is compatible with the current expectations of the terminal interest rate in Europe of 3%, the real result may be different. But it does serve to show how the variable yield works in a practical case that may be close to reality. You can see below an annex of the current expectations of interest rates in the world.

The result of this simulation tells us that:

- Of the €100,000 we would have accumulated €107,065.

- Accumulating interest of €7.065.

- Which is equivalent to accumulating a yield of 7.06% or

- an yield for the whole period of 2.3%.

The resulting annualized return would be 2.3% during the period analyzed, as a result of the different variable yields simulated for each period.

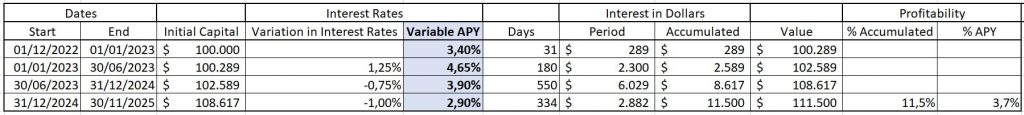

Below we show a similar example now with expected US dollar interest rates, which are higher at the moment.

Note: this is a simple simulation based on interest rate expectations. It is no commitment that the simulated average yields will be obtained.

The mechanics are the same, except that in this case it is more likely to obtain an annualized return. The result of this simulation tells us that:

- Of the $100,000 we would have accumulated $111,500.

- Accumulating an interest of $11,500

- Which is equivalent to accumulating a return of 11.5% or

- a yield for the whole period of 3.7%.

The resulting annualized return would be 3.7% during the period analyzed, as a result of the different variable yields simulated for each period. As they are higher in each period in this simulation in dollars, there is an increase of 1.4 percentage points with respect to the simulation made for the Euro.

We hope these examples will help you better understand the concept of variable yields and their potential advantages in the current environment.