If you want to open a portfolio of index funds on inbestMe, you will need a device connected to the internet and the following documents: your identity card (a photograph) and the certificate of ownership of the bank account from which you will make the deposits. Once you have both documents, you will be able to open it in a comfortable and simple way. In addition, you will benefit from its wide range of funds as well as its reduced costs.

In the end, the objective of opening a portfolio of index funds on inbestMe is to increase your assets in a healthy way and adapted to your profile. To do so, follow the steps detailed below.

Table of contents

ToggleWhat is an index fund portfolio?

A portfolio of index funds is a type of account in which the index funds we contract appear together with the value of our participation. In this way, we can always have our investments under control, since normally not only the current net asset value (the money we will receive in case we sell our total participation) is shown, but also the evolution of our money: that is, if those funds have been revalued or not and how much.

Why choose index funds?

When it comes to choosing a type of asset to invest our money, index funds stand out as a good choice. Among the advantages offered by this type of product, the following stand out:

- Low fees: index funds are investment products with low implicit costs, which helps them achieve better results.

- Easy to understand and follow: once you know the index to which your index fund is linked, you can understand both what you are investing in and how it is performing.

- Diversification: the wide range of index funds and their ability to replicate any index makes them a perfect product to diversify risk.

- The long term: investing in index funds is a long-distance race, so it is vital to understand that the most important thing is to keep the money over time.

The sum of these characteristics not only makes them a perfect product for any type of investor, but also allows them to obtain good results on a recurring basis.

inbestMe index funds portfolio

Before we look at how to open an index fund portfolio on inbestMe, first there are a few more things you should know about it. First of all, note that the investment platform offers you to open two different index fund portfolios: Standard and SRI (socially responsible).

- The Standard index fund portfolio: if you opt for it, the products you will have access to are not classified as socially responsible. This means that their investments are not guided by environmental or social criteria, but seek to follow more classical indexes. This does not imply that they are more or less profitable, but simply the investment philosophy.

- SRI index funds portfolio: in this case, your portfolio will have between 90% and 100% of funds classified as SRI/ESG, i.e., that in addition to following the profitability criteria seek to promote other values such as sustainability and being socially responsible. This implies, for example, having funds in your portfolio that exclude controversial industries.

Secondly, you can open a portfolio of index funds on inbestMe from an amount of 1,000 euros. However, the composition of your index fund portfolio depends on the amount invested, regardless of whether you have chosen the standard or SRI funds option. Thus, for portfolios holding an investment of less than 5,000 euros, two funds will be chosen from among four different options, while, for a larger capital, the options for creating the portfolio goes up to 16.

In addition, depending on the amount invested, you will have to face different costs. Specifically, inbestMe imposes the following fees:

COSTS

| Amount invested | Management fee | Trading and depository costs | Average implicit cost |

| 1.000 € to 4.999,99 € | 0,41% | 0,105% | 0,13% |

| 5.000 € to 99.999,99 € | 0,41% | 0,105% | 0,14% |

| 100.000 € to 499.999,99 € | 0,38% | 0,105% | 0,14% |

| 500.000 € to 999.999,99 € | 0,30% | 0,105% | 0,14% |

| 1M € to 4.999.999,99 € | 0,25% | 0,06% | 0,14% |

| More than 5M € | 0,13% | 0,06% | 0,14% |

VAT included.

Finally, please note that, in all cases, the final funds of the portfolio may vary, as the Investment Committee of the investment platform is constantly improving the portfolios according to the investor profile of each user. In addition, if you already have funds in other entities, you will be able to transfer them to inbestMe without tax impact.

Steps to open the inbestMe index fund portfolio

Once you know the most important details about investing in index funds and the inbestMe platform, it is time to start the process. Remember to have the required documentation ready: a copy of your ID card and the certificate of ownership of the bank account from which the transfer will be made. In case you open your portfolio of funds with a NIE you will also need your passport or National ID (national identification document of your country of origin).

Once you have the documentation at hand and a device connected to the internet, it is time to open an inbestMe index fund portfolio.

Step 1: Apply to open an inbestMe index fund portfolio

The first thing you need to do to open an inbestMe index fund portfolio is to access the inbestMe website. Once you have logged in, go to the investment section (which you will find on the top bar of the website) and click on the option you have chosen: standard funds or SRI funds.

Once you are in one of the two options, it will be time to request to open your index fund portfolio by clicking on the “Open Index Funds” section at the top and bottom of the page.

Step 2: Select target and horizon

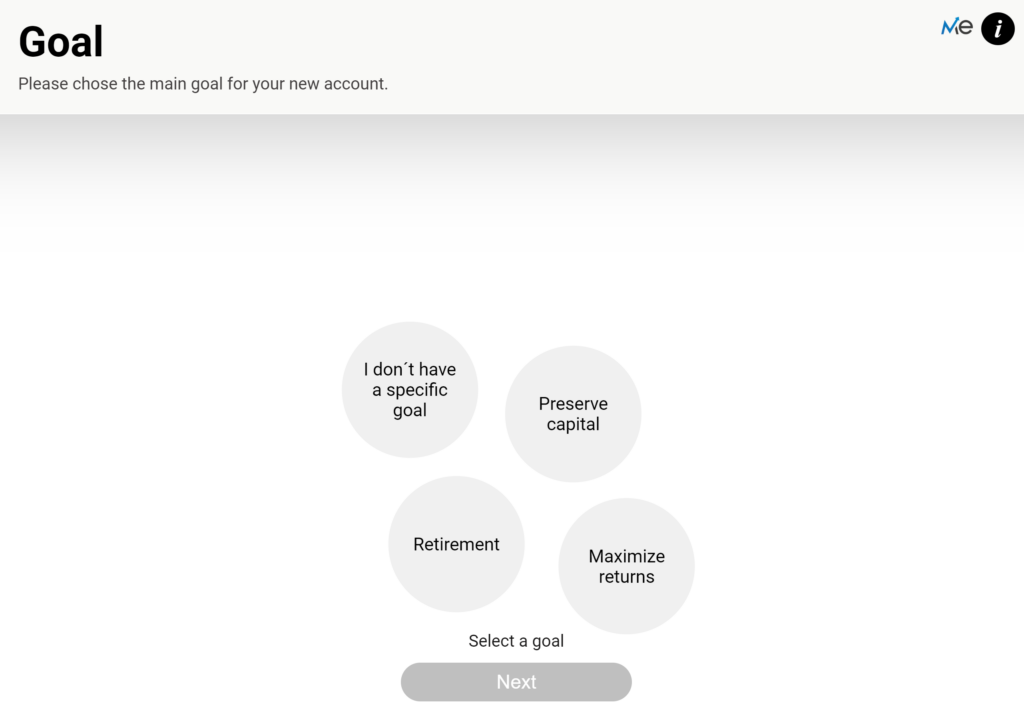

Once you have clicked on “Open Index Funds” the next step is to choose your investment objective from the following options offered by the website:

Remember that having clear objectives before jumping into the investment world is essential, as this will make it easier for you to achieve long-term financial success. In this case, by choosing one of the options offered by inbestMe you are allowing its algorithms to adopt the type of investment that best suits you:

- “Preserve capital“: your savings will be invested in very conservative index funds. This eliminates the risk of losses, but also limits returns.

- “Maximize returns“: the type of investment is totally different from the previous one. The funds in your portfolio will be riskier (may cause losses), but in return the return can be higher.

- “Retirement“: a mixture of both, which will depend on other factors. Thus, if you are close to retirement age the objective will be more to preserve capital, while if you are younger you can adopt a more aggressive strategy. However, remember that you always have the option of opening a pension plan on inbestMe itself for this objective.

- “I don’t have a specific objective“: if you have not decided on any of the above, don’t worry, as you can decide on this option, which will take shape with future information.

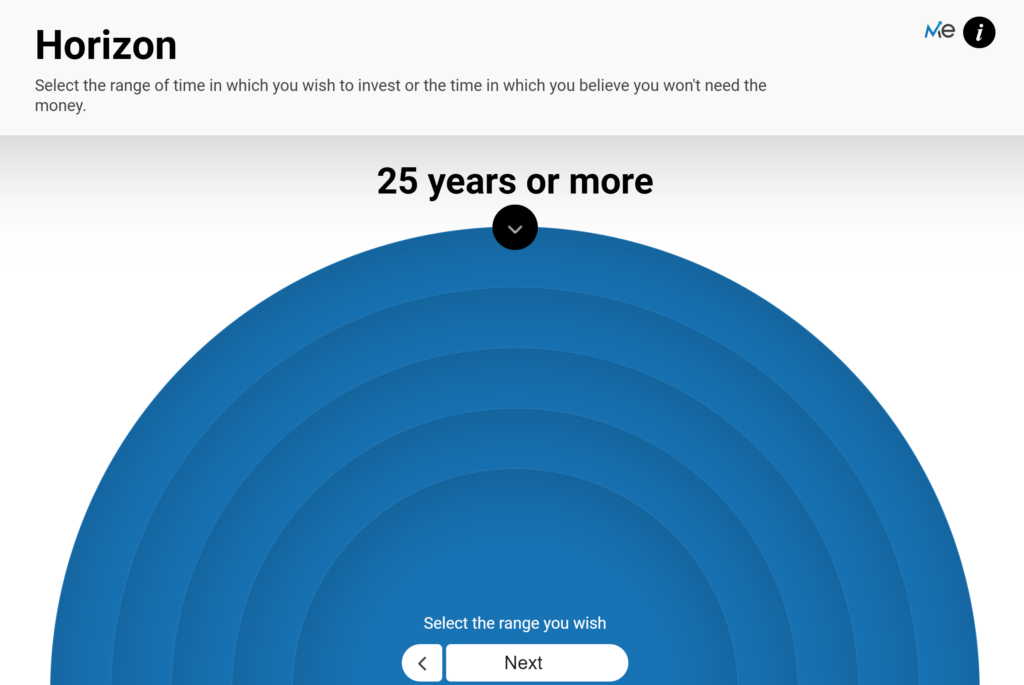

Once you have chosen a goal, it is also essential to indicate the time horizon you have to meet it, as it is also an essential part for the algorithm to choose one type of investment or another. In the case of inbestMe, you can choose from a time horizon ranging from one year (although for such short periods it is perhaps better to consider opening the inbestMe savings portfolio, which offers up to 3.5% return) to 25 years or more.

To make your selection you must move the arrow that appears in the image.

As a piece of advice, if you are going to create a portfolio of index funds with the intention of making your savings profitable, it is best to always try to do it in the long term.

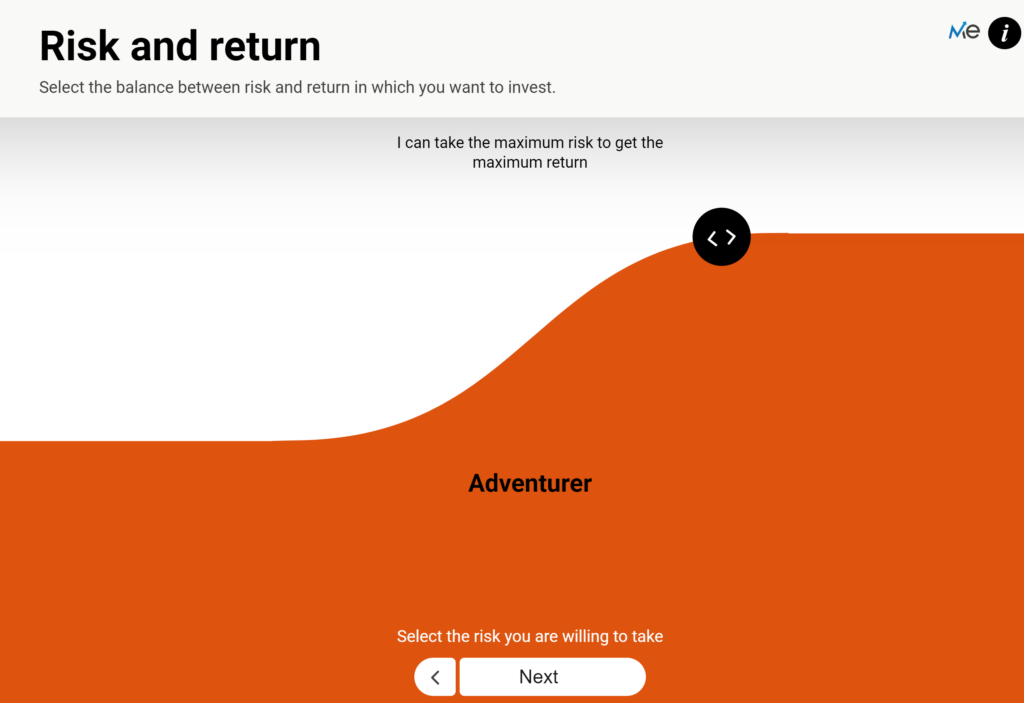

Step 3: Choose between risk and return

The next step is to decide how much return you want based on the risk you are willing to tolerate. Although this is the fourth point, do not underestimate this decision, as it is one of the main issues facing all investors. It can also help you better understand your investor profile.

At this point, remember that the two issues are usually proportional, so that more return will require risk. In the case of inbestMe, the options are:

- “Very Conservative“: you do not tolerate risk and your objective will be to preserve capital.

- “Cautious“: you may include some funds with a little more risk. Even so, your objective is to preserve capital.

- “Balanced“: you accept the risk, but try to limit it, so that both are balanced.

- “Determined“: risk is not a problem, in this case you will actively seek an aggressive strategy to increase profitability, even if it may cause some losses.

- “Adventurous“: without any fear of losses. The clear objective is to maximize profitability and an aggressive stance is adopted. With it, major losses are also likely to be incurred.

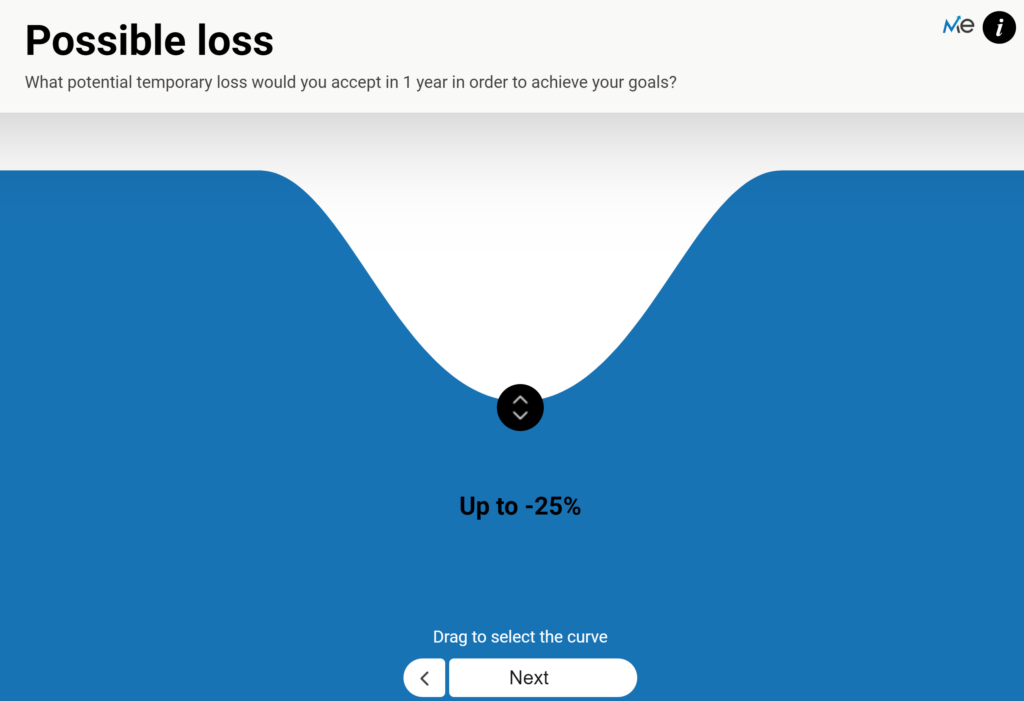

Once you have chosen between profitability and risk, it is time to go back to the same thing, but with a real application. In this case, you must indicate how much you are willing to lose in case the investment does not work out without withdrawing your money. The options are between 5% and 30%. Thus, for an investment of 10,000 euros would mean having in your portfolio of index funds or 9,500 euros or 7,000 euros and being able to ‘sleep well’ despite this.

Note that this percentage can never be 0%, hence the minimum is 5%. The reason is that investing in equities, as index funds do, requires assuming a minimum risk, which in this case is calculated around that percentage. If you think you are not willing to suffer a loss, however small, it is better to look at other products.

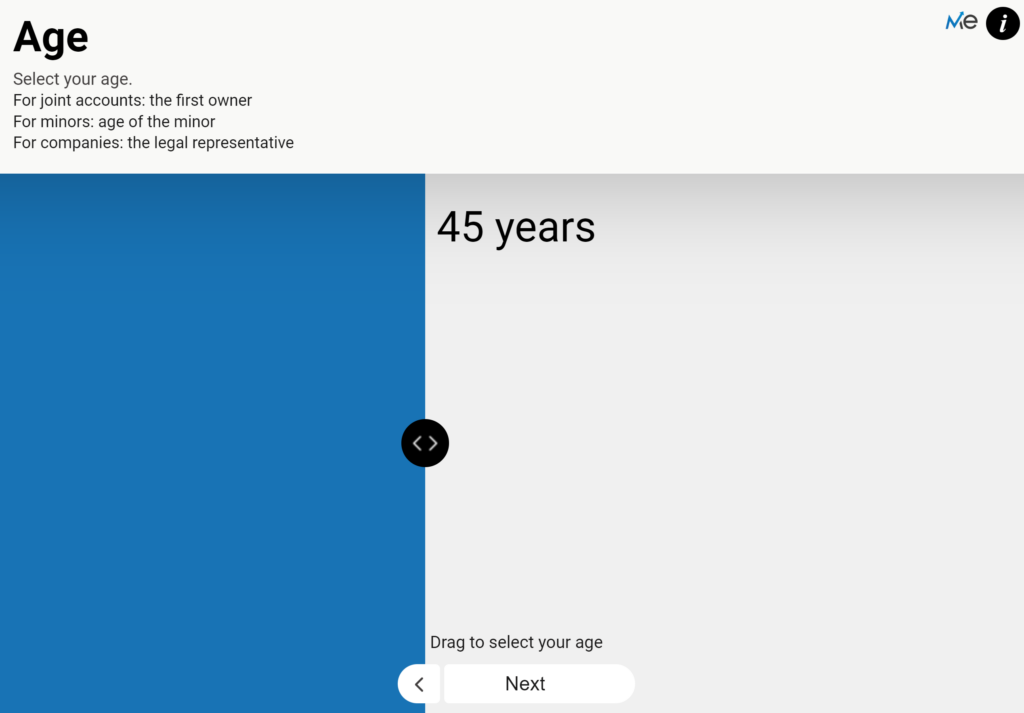

Step 4: personal data, age and employment status

The next two steps are to indicate some personal data such as your age and your employment status. Both are important because they also define how your index fund portfolio should be configured.

As far as age is concerned, please note that:

- For joint portfolios, enter the age of the first holder.

- If the portfolio is for a minor, enter the age of the minor.

- In the case of companies, enter the age of the legal representative.

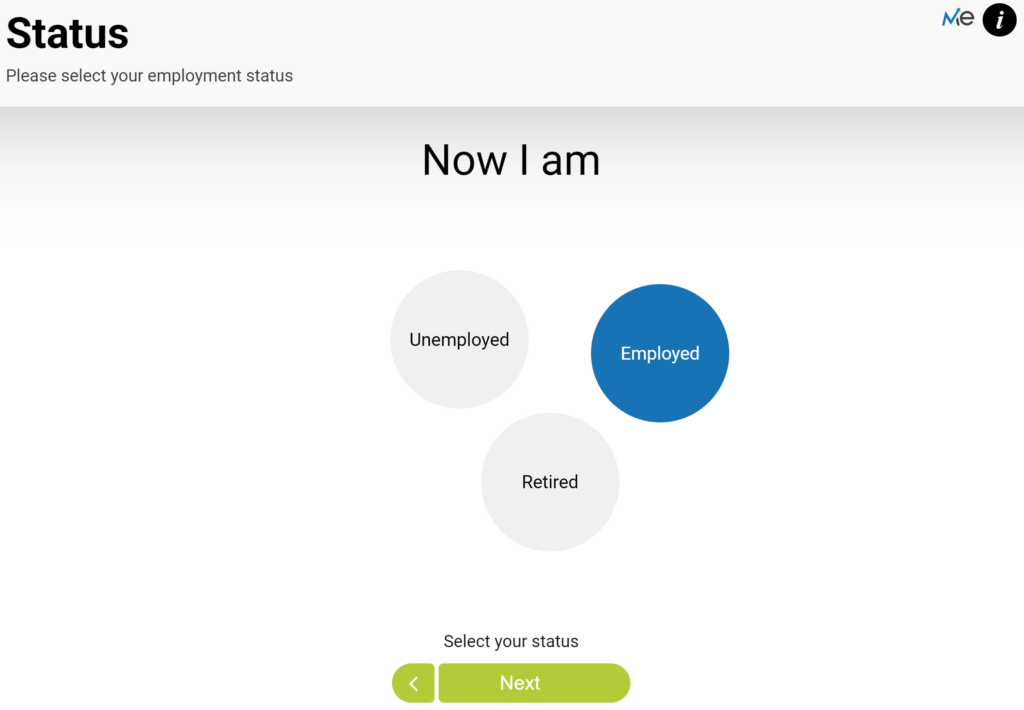

Then, all you have to do is indicate your employment status among the three classic options: “working”, “unemployed” or “retired”.

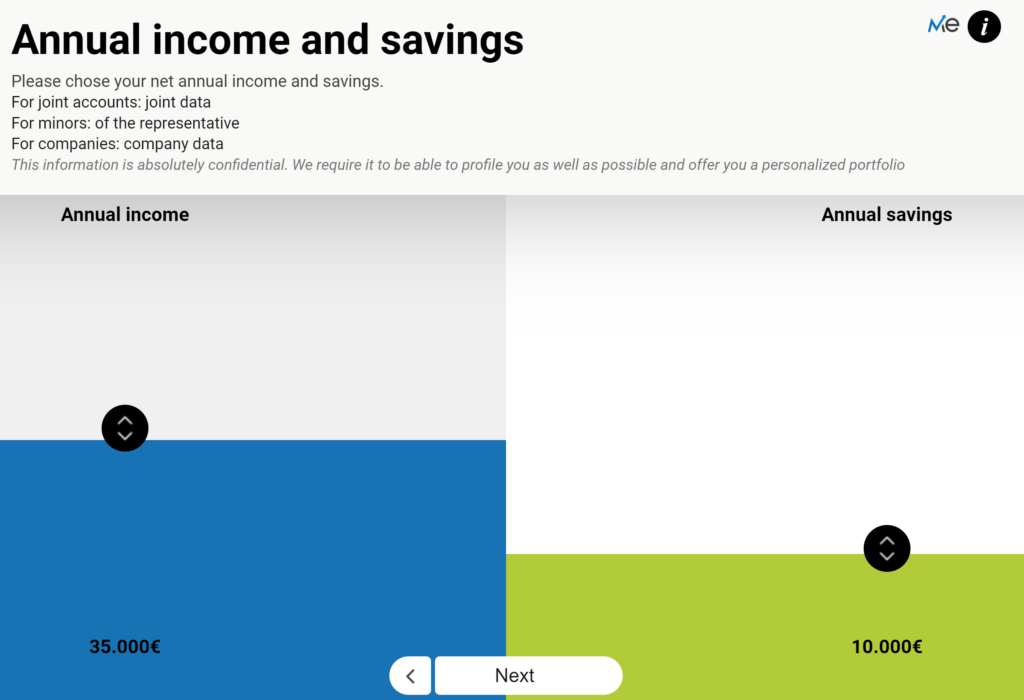

Step 5: Income, savings and net worth

The next steps focus on your financial situation, so you should make a short summary of your annual income and savings, as well as your net worth. In these steps, you should be as accurate as possible, so that the algorithm can be better calibrated. After all, it is important to understand that it is not the same to achieve certain objectives with certain incomes or with others, which is also true for savings.

The way to select both is very simple, as you only have to move the arrows. As for the different types of portfolios, follow the advice given on the page itself:

- For joint accounts, enter the data of both participants.

- For minors, the data of the representative who opened the portfolio.

- For companies, simply enter the company information.

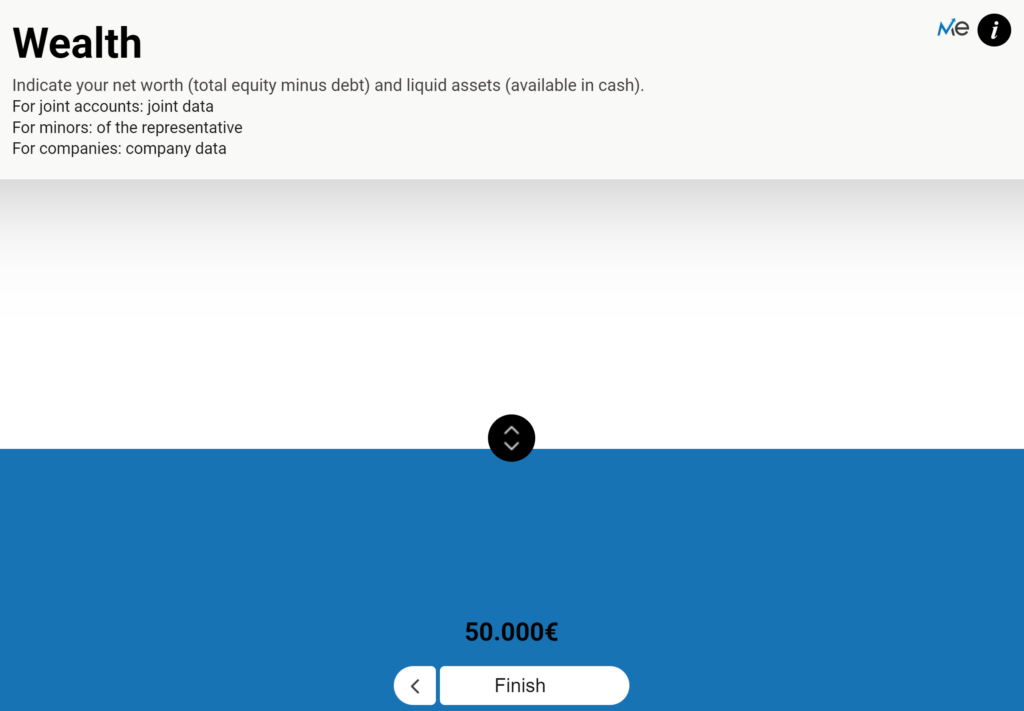

The last step in the questionnaire is to indicate your net worth. Remember that your net worth will be all your savings, including the liquid assets you have in the bank and those you have in savings or investment products, minus the debts you have incurred. Also, if you have a mortgage, not everything is debt, since the account is: value of the house minus the amount you owe.

Also note that:

- For joint accounts, enter the data of both participants.

- For minors, the assets of the representative who opened the portfolio.

- For company, the company’s data.

Once you have entered the number, you can click Finish.

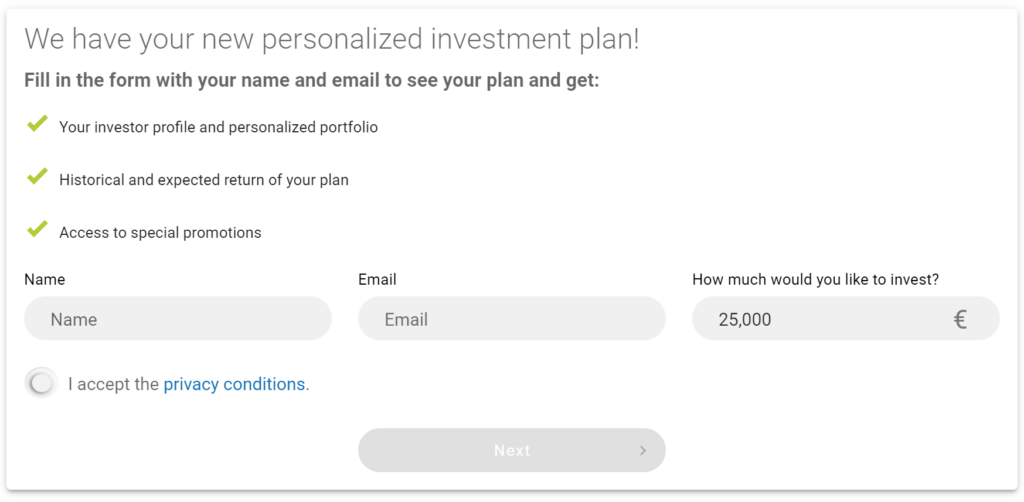

Step 6: enter your personal data

Finally, once the questionnaire is completed, you must enter the following data:

- Name

- The amount you want to invest

And once you have done so, you must accept the privacy conditions, once you have read them.

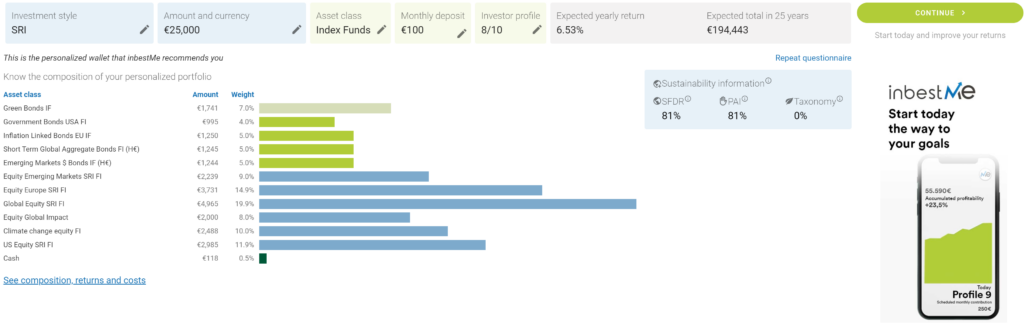

Later on, you must continue to fill in some more information such as whether you want to maintain or change the amount to invest and if you prefer SRI index funds (or, in default, Standard). In both cases, you will have access to a range of likely returns. In addition, if you choose the SRI option you can determine yourself what kind of criteria are most important or let the platform itself act in a general way.

In the end, the result will be a first sketch of what will be your inbestMe index fund portfolio, a plan that you can also receive by mail if you prefer.

Step 7: Password creation and completion of the process

Ultimately, you will arrive at the login page of your index funds portfolio, which you have already opened, and for which you will only need to create a password with which to identify yourself in the future (along with your email). Finally, once you have clicked on open account you will receive a confirmation email which you must click on in order to register your portfolio of index funds in inbestMe.

Once you have followed all the steps, you will be notified that the registration has been successful and you will be able to choose between the possible portfolios: individual, joint or company. Choose the format that best suits you to complete the process by filling in the missing personal data such as your telephone number or bank account for the transfer of the money.

With these simple steps, you will be able to have your portfolio of index funds in inbestMe perfectly open, with which you can grow your assets for the future.