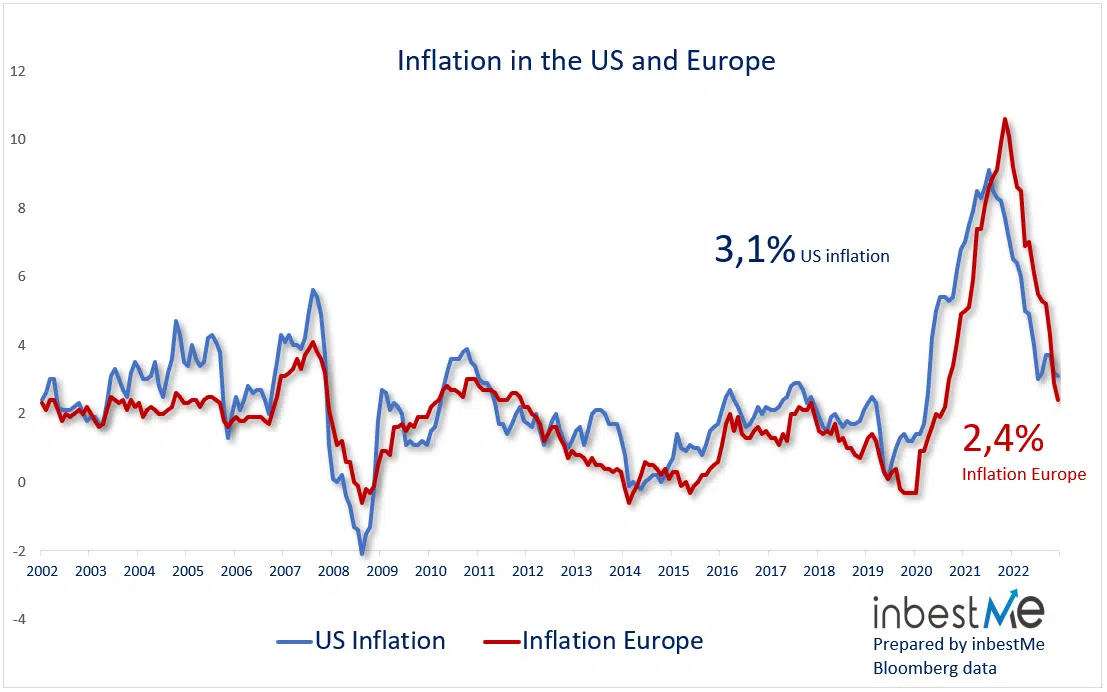

This was an important week as all the major central banks met. It was important to see what message they wanted to send to the markets after the latest inflation figures fell short of expectations in both the US and Europe and investors had aggressively started to price rate cuts for next year.

The Federal Reserve (FED) more moderate

The message until now was that they would have kept interest rates “higher for longer”. They had in fact stressed many times the importance of keeping inflation expectations low, as high interest rates usually help to keep prices in check.

Unexpectedly, however, the Federal Reserve signalled that it now expects a total of 0.75% interest rate cuts next year. This is significantly larger than the previous expectation of a cut of just 0.25% in 2024. This takes the Federal Reserve forecast more in line with the one of investors that, before the meeting, were already expecting a total of around 1.20% interest rates cut next year.

Powell explicitly said that the members of the board had discussed the timing for a reduction in interest rates. During the last meeting, the president of the FED said that this was not even considered yet. It is quite a remarkable change in attitude.

The market reaction was euphoric as the prospect of rate reduction came in the absence, until now at least, of a recession. It was widely expected that the Federal Reserve would have cut rates only after a significant slow-down of the economy and an increase of the unemployment. According to Bloomberg calculations, the reaction of markets, in both stocks and bonds, was the most positive to a FED meeting in the last 15 years.

The European Central Bank (ECB) remains committed to the

Thursday was then the ECB’s decision day. For the ECB, however, there was no change in direction. President Lagarde reiterated that the central bank still has to remain vigilant against inflation and that the possibility of an interest rate cut was not even considered by the board in its discussions.

It is likely that the ECB, just as it started to raise rates after the Fed, will also be slower to reduce them, despite a more stagnant economy.

The market currently estimates more than a 75% chance of a March rate cut by the Fed and only a 50% chance of a cut by the ECB.

The table below shows the probabilities associated with different interest rate levels for upcoming Fed meetings based on fed funds futures prices. It can be easily seen that the possibility of another hike is no longer considered.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

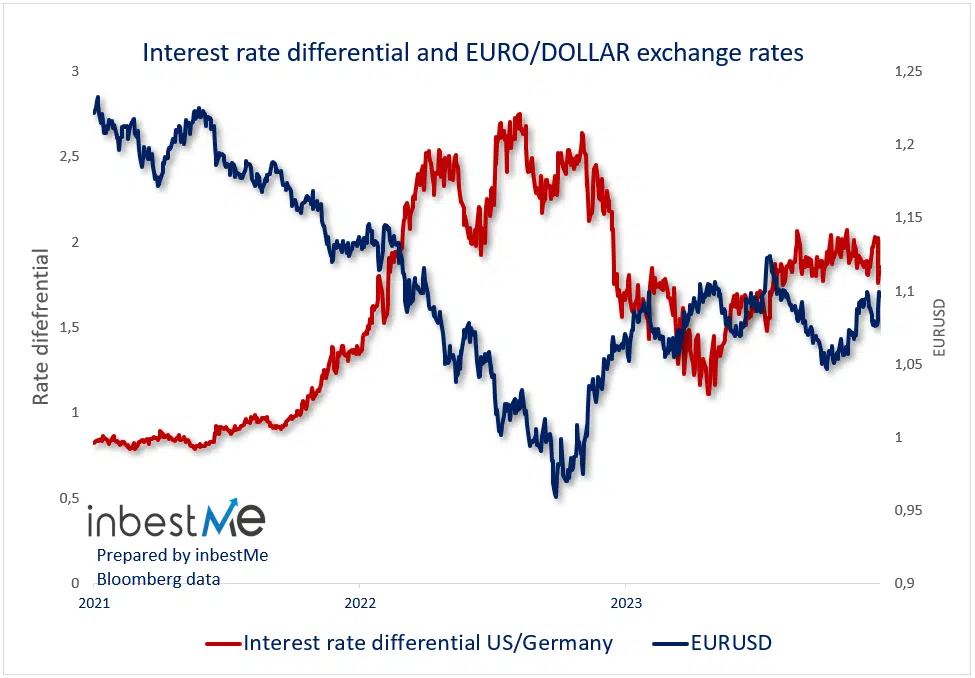

The fact that the FED could be quicker than the ECB in lowering interest rates was reflected in the reaction of the euro versus the dollar that regained 1,10. The more the interest rate differential is favorable to the dollar, the stronger it trades against the euro. The opposite happens when the differential decreases, as in this case.

The message anyway, also for the ECB, is that the tightening cycle is much likely over. There could be a small delay for the ECB in lowering rates but, at this stage, it seems unlikely that we will see other rate hikes.

More options in the face of high, stable or declining interest rates

Interest rates now at higher levels add options for savers and investors.

In this context, inbestMe’s savings portfolio (yield 3.5% in Euros or 5% in Dollars) remain an ideal option for the short term, taking advantage of this higher level of interest rates. You will hardly find more efficient options than our savings portfolios.

On the other hand, our recently relaunched bond portfolios (profile 0) are positioned to benefit from a more attractive situation in the fixed income market, where the value of bonds can rise as rates fall (due to their inverse relationship).

Finally, for the medium to long-term investor, inbestMe’s diversified portfolios of both index funds and ETFs offer a balanced and diversified strategy that can capitalize on both a better fixed income situation (with stable or trending rates) and a more favorable environment for equities over the long term.

Find out which portfolio is right for you based on your financial objectives.