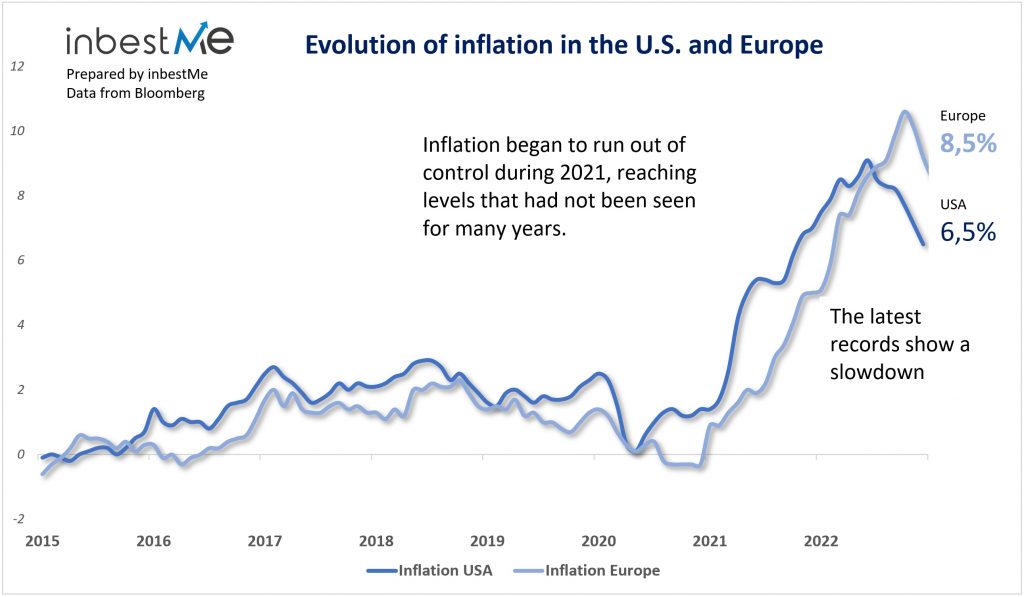

During the last years we have witnessed a period of inflation never seen in the last 40 years. With the benefit of hindsight, it might be interesting to reflect on what caused this spike in inflation.

It is often said that the Quantitative Programmes of central banks were responsible for the increase in inflation. During these programmes, central banks bought a huge amount of financial assets, bonds in particular. Interest rates were at zero already, and to pursue more monetary easing central banks started buying assets.

Does this have an effect on inflation?

Let’s decompose the dynamics of quantitative easing. Usually is either commercial banks or other institutional investors that sell the bonds to the central bank. It is not private investors.

Suppose it is a bank. When the central bank buys the bond from the bank, it does not send a check but credits the account that the commercial bank has at the central bank. The funds that commercial banks have deposited at the central bank are also called reserves.

So, the purchase of the bond increases the reserves of the bank. Will the bank spend this money in the real economy, pushing prices higher? Not really. Having more reserves, will it lend more to the real economy? Not necessarily, it depends on if the banks see profitable lending opportunities.

More often it is an institutional investor, a pension fund for instance, that sells the bonds to the central bank. It will do this not directly but though a commercial bank that has an account with the central bank, but this does not matter a lot for now. The final result will be that, instead of having a bond in portfolio, it will be credited its current account by an amount equivalent to the value of the bond. So now it will have money in a deposit that very likely will utilize to buy higher yielding financial assets.

This will tend to push the price of these financial assets higher. Does this create real economy inflation?

Not necessarily. The money involved in this transaction has never left the financial sector. It is not money that has been spent in the real economy pushing prices higher. The pension fund will certainly not buy anything in the real economy.

What it can create is financial asset price inflation, meaning pushing market prices higher, but the effect on real economy prices will be very limited.

This does not mean that quantitative easing is not creating distortions in the functioning of markets. Also, due to the increase of prices of financial assets, it produces an increase in wealth inequality. But as far as the effect on real economy inflation are concerned, these are quite limited and indirect.

Japan did quantitative easing programmes for many years without having any increase in inflation.

So, what really caused inflation?

There are two main reasons.

The first one is given by the pandemic and then the war in Ukraine. Both these factors pushed the prices of commodities up and blocked the global supply chains, making it more difficult to produce and ship goods.

This produced a kind of inflation that is named cost inflation that was particularly felt in Europe. The cost of acquiring imported goods for business and individuals increased.

There is then another big reason explaining why inflation increased. To respond to the pandemic, the governments started some huge fiscal programmes. In the US alone, around 5000 billion dollars were injected in the economy to sustain families and businesses.

This is money that arrived to the real economy. It did not remain only within the financial sector, as the money coming from the quantitative easing did.

It produced what is called demand inflation, meaning that the prices are pushed higher by the strong demand. Coupled with the fact that due to the pandemic, goods became difficult to produce and ship, the effect of the increase in demand was even stronger.

The money that the government sent to people strengthened the balance sheet of families that were able to repay some of their debt and to consume more.

It is still not very clear how the economy is still relatively resilient after central banks increased interest rates so much. The reason has probably to be found in this huge fiscal expansion that put so much money in the pockets of people and that still sustain consumption.

The other side of the coin is that this created inflation and a lot of more debt for the government.