Opening a savings portfolio on inbestMe is a comfortable and simple process that will not take you more than a few minutes, thanks to the fact that it is a completely online process with guided steps. Of course, in addition to a device connected to the Internet to register on the platform, you will also need to provide some personal information and also provide a couple of documents such as your identity card (a photograph) and the certificate of ownership of the bank account from which you will make the deposits.

So, if you want to get some return on your savings by opening a savings portfolio at inbestMe, read on and see how.

Table of contents

ToggleWhat is a savings portfolio?

A savings portfolio is a financial product that allows you to obtain a return measured through the IRR, Internal Rate of Return, for the money you deposit in it, without giving up the freedom to dispose of your savings. This feature makes it a great alternative to other bank accounts in which you also have your money available, but the return you get is small or zero. However, bear in mind that the money you will receive will depend on the amount you keep in it, so the more savings you deposit, the higher the interest you will receive.

Moreover, in the specific case of the inbestMe savings portfolio, you should know that your money is totally safe, since the platform is backed by FOGAIN (Investment Guarantee Fund in Spain) and supervised by the CNMV (National Securities Market Commission).

Why choose to open a savings portfolio?

Opening a savings portfolio is always a good idea, as it allows you to obtain a risk-free return on your savings. However, at this time, with interest rates at historically high levels, it is an even better idea, since the assets in which you invest, mainly monetary, benefit from them. Although these are not the only advantages, as they also stand out:

- Flexibility: No minimums or maximums, that is, you can put in any amount of money you want, from 1,000 euros to one million (in the case of inbestMe), and get a remuneration.

- Liquidity: you can withdraw the money whenever you want or need it and in a week you will have it available for use.

- Taxation: By not paying dividends, there is a tax deferral, i.e. you do not have to pay taxes on the latent profits.

inbestMe savings portfolio

First, before opening a savings portfolio at inbestMe, you should know some important details about it. One of them is that you can open two different savings portfolios: in euros and in dollars.

- Euro savings portfolio: currently offers a Yield of 3.5%. This is a portfolio made up of the best monetary funds denominated in euros, which means that the IRR offered is linked to the interbank rates of the European Central Bank. As a particularity, you can invest in it from 1,000 euros, while the rest of the features such as liquidity or taxation is the same.

- Dollar savings portfolio: currently offers a Yield of 5%. In this case, the assets that make up the savings portfolio are subject to the interbank rates of the United States Federal Reserve (FED). In addition, in this case, the minimum investment is 5,000 euros or dollars.

Another particularity to take into account has to do with the Yield, since it is not a fixed return, but it is variable and is updated according to different parameters in addition to interest rates. InbestMe has designed a portfolio to reduce volatility, optimize performance and get the most for your money, but it may change in the future if the ECB or the FED change interest rates.

Steps to open an inbestMe savings portfolio

Now that you know all the details about this product, it is time to open the inbestMe savings portfolio and benefit from all its advantages. To do so, you just need to follow the steps below, so that it is easier and faster for you to do it.

Remember, however, that you must have the required documentation ready: that is, a copy of your ID and the certificate of ownership of the bank account from which the transfer will be made. In case you open your portfolio of funds with a NIE you will also need your passport or National ID (national identification document of your country of origin). Once you have it, it is time to get started.

Step 1: Apply to open a savings portfolio on inbestMe

Regardless of whether you have chosen to open the euro or dollar savings portfolio offered by inbestMe, the first step is the same: apply to open the account. To do this, you simply have to click on one of the action buttons that you can find on the corresponding portfolio page, which you have both above and below.

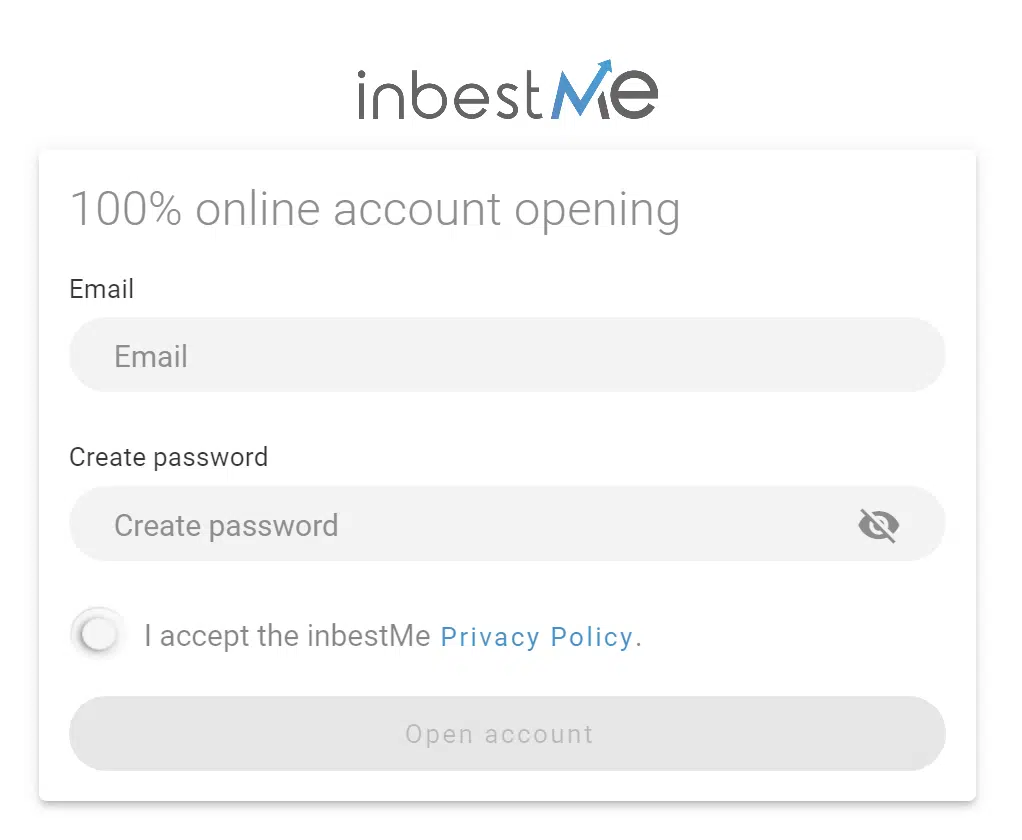

Step 2: enter your email address and create a password

The next step will be to insert your email and create a password, you must also accept the privacy policy of inbestMe, both data will be key to enter your account and access your savings portfolio. Therefore, it is best to use your usual email address and create a password that is difficult to guess, but with which you are familiar (much safer than copying it from another site).

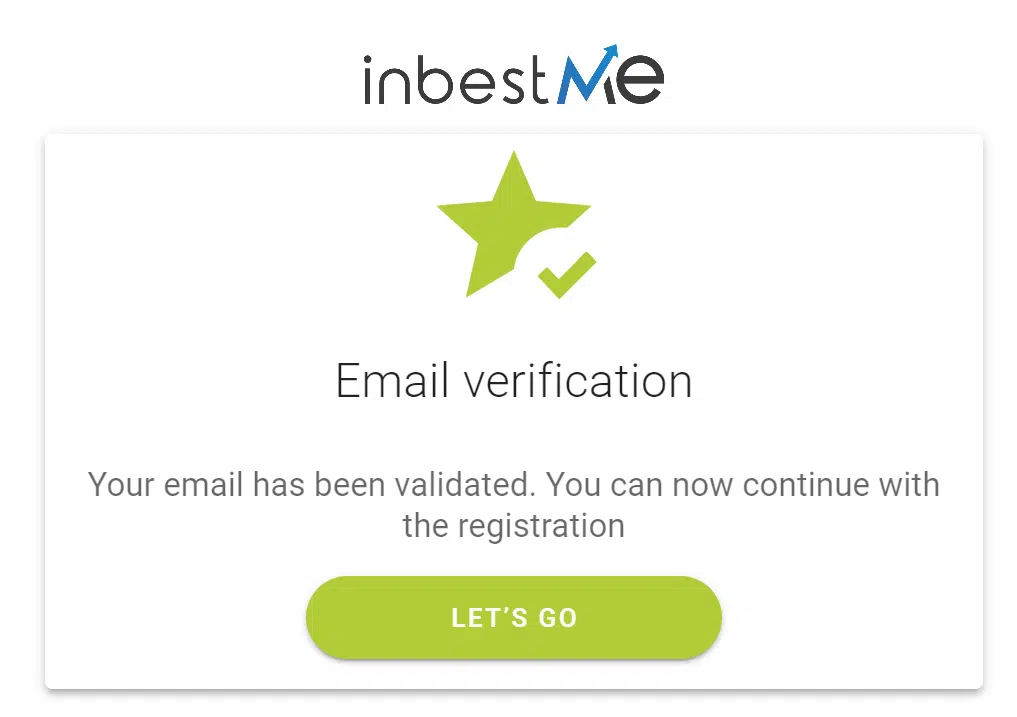

Once you have done both, a window will open informing you that an email has been sent to your email address, with the intention of verifying that the email address has been entered correctly. Simply go to your email, click on the inbestMe email and then click on the ‘click here to confirm email’ section. Once done, you will get a message like this:

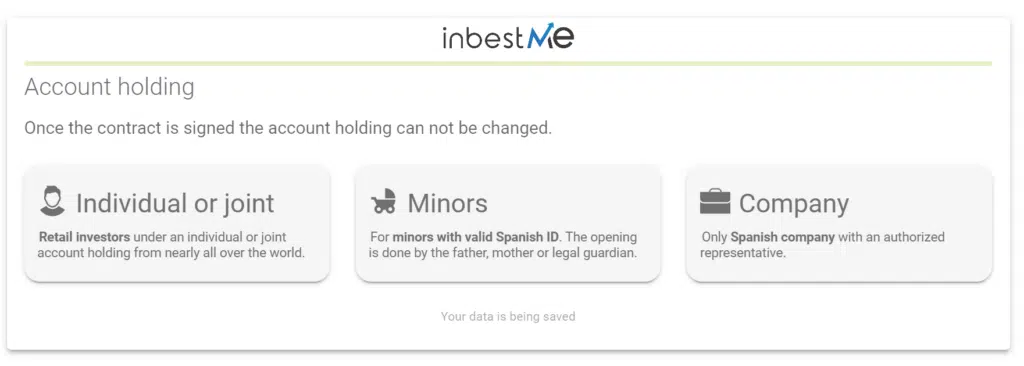

Step 3: Final details

Once you have continued, the next step is to select which type of account or portfolio you are interested in among the options available inbestMe: individual or joint, minor or company. Remember that, depending on one choice or another, the data you will need will be different, although they are explained, as you will see in the following image.

Once you have completed the questionnaire, you must enter your telephone number and prepare to verify your identity. Specifically, you will be asked for:

- Take a photo of your ID card.

- Record a video showing your face, so that it can be verified that the ID card corresponds to the photo provided.

Finally, you will only need to provide your bank details, including the ownership of the account, and decide how much money you want to deposit in the savings portfolio to enjoy its advantages. Also keep in mind that if you have other products, such as a portfolio of index funds or ETFs, you can benefit from moving the money from your portfolio to these products, so that they always maximize what you get for your savings.