Surely these types of headlines related to Bond Portfolios have reached your ears in recent months:

The change in the bonus regime in general did not take us by surprise. In our blog we already anticipated in November 2022 that a new era would begin for bonds or fixed income.

Table of contents

ToggleThe new era of bonds

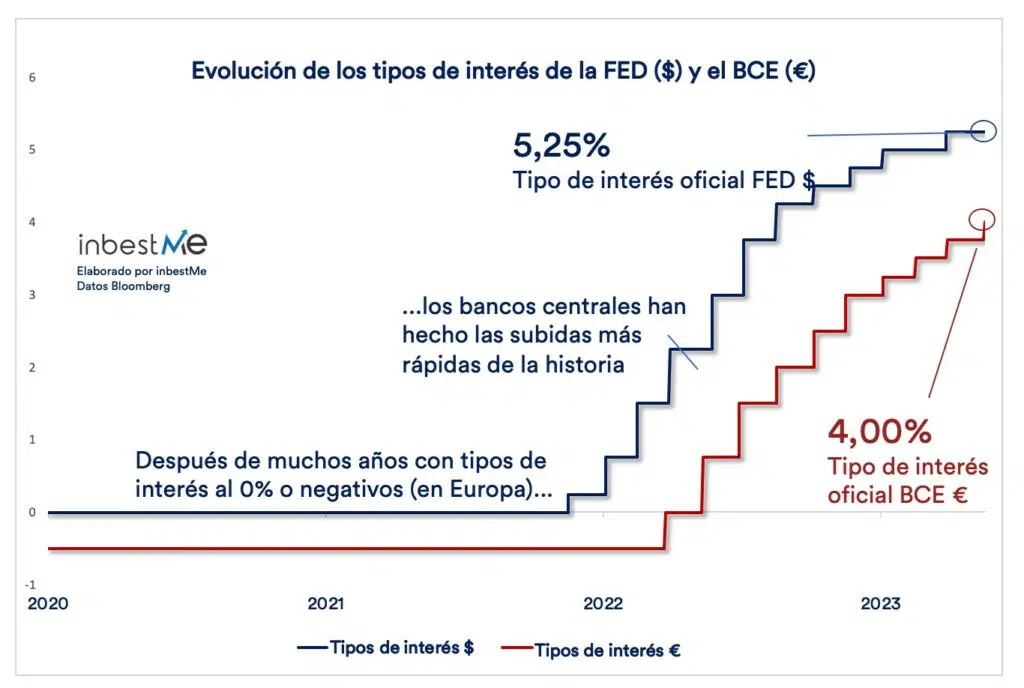

Without a doubt, the historically rapid rise in interest rates has generated renewed interest in bonds or fixed income.

However, this rapid rise in rates caused 2022 to be exceptionally bad, due to the combined decline in fixed income (bonds) and variable income (stocks).

In the medium and long term, these yield levels seem to be interesting again, after years of abnormality with interest rates close to zero or negative. This could bode well for expected bond returns, which will also be reflected in diversified bond and stock portfolios. In relation to this, remember that at the beginning of the year we revised upward the expected returns of our portfolios.

In summary, some of the reasons why it makes sense to consider investing in a 100% bond portfolio, at this time we would highlight:

-Attractive yields: after many years with negative rates, bond yields are now at historically attractive levels.

-Counterbalance to volatility: while equities continue to be one of the best ways to invest in the long term, in the short term they can have significant ups and downs: bonds usually offer relative stability and are more acceptable to the conservative investor. This is not always the case, with 2022 being a disastrous experience for the bondholder.

-Diversification: unlike investing in a bond, investing in a bond portfolio involves diversifying between government, corporate, short- or long-term bonds and from different geographic regions. This allows the risk to be more spread and adapted to your investment objectives.

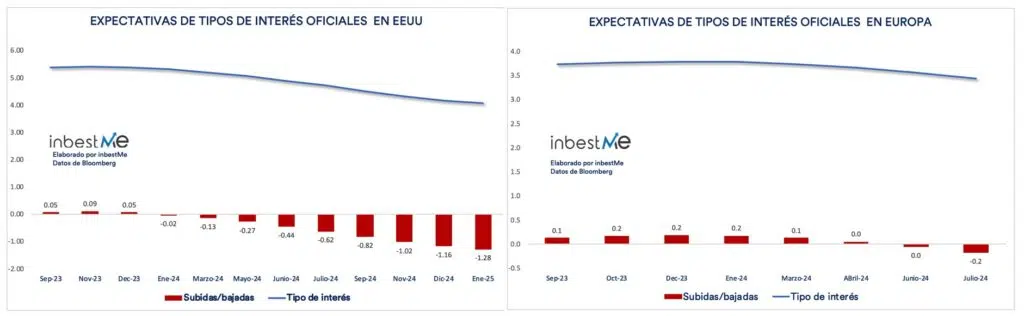

-Anticipate the stoppage of increases or the reduction in rates: this last reason is more opportunistic in nature and, therefore, may or may not occur. It has to do with the fact that it seems that we are already in a scenario that suggests a pause or even cuts in interest rates for next year. If so, bonds purchased today could see an increase in value. A well-structured portfolio could benefit significantly from these movements.

Profile 0 and the Bonds Portfolios at inbestMe

From its inception, inbestMe services were conceived to enable investment by objectives, offering maximum customization and financial planning with multiple accounts. This vision included providing a very broad offering of up to 11 risk profiles in almost all portfolios, with profile 0 corresponding to a bond portfolio.

Taking advantage of the new bond and interest rate situation, we have decided to make our offer of 100% bond portfolios (profile 0) more visible so that this option is clear to our current and future clients.

We want the existing offer to be more visible on our website and platform in general. Contracting a bond portfolio with inbestMe is much easier and more efficient than trying to go to treasury auctions, especially from a tax point of view.

inbestMe’s bond portfolios are made up of index funds that accumulate profitability and are transferable, deferring taxation. ETF portfolios are made up of ETFs that also accumulate (but are not transferable).

What we have discussed for treasury bills is also applicable to the direct purchase of other bonds: in this case not only must the tax issue be taken into account, but it also requires a high level of knowledge of what fixed income is and which can actually be much more variable (read complex) than its name indicates.

To contract a portfolio of fixed income bonds at inbestMe you simply have to complete a registration and profiling process at inbestMe or contract a new investment portfolio and finally make sure that profile 0 is the one selected, which we will also refer to from now on. as well as the 100% bond portfolio.

This relaunch complements the launch of inbestMe’s savings portfolios (which are still very short-term bonds) in November 2022.

The inbestMe 100% bond portfolio: a compromise between performance and duration

At inbestMe we are committed to indexed management.

This means that our investment committee makes a selection of the best index funds or ETFs to achieve the best distribution and risk/return ratio for each risk profile.

This implies, therefore, managing the distribution seeking this optimization.

Along with this relaunch of the 100% bond portfolio, the investment committee has reviewed profile 0 of our investment portfolios, which already had a 100% distribution in bonds, to adapt it to the current situation of fixed income, and Therefore, reviewing what is the best balance for the current moment between the short and long term, to achieve a good compromise between performance and duration risk… In more technical terms, this means making a decision about the average duration of the portfolio: specifically, the inbestMe investment committee has taken advantage of this review to simplify and shorten the duration of the profile 0 or bond portfolio.

In line with this review, the average portfolio duration will generally be below 2 years to limit duration risk.

As a general rule and to achieve this balance, the 100% bond portfolio can include:

- money market index funds (or ETFs)

- index funds (or ETFs) floaters

- short-term corporate or government bond index funds (or ETFs)

- long-term corporate or government bond index funds (or ETFs)

Unlike the other portfolios in inbestMe, these portfolios can combine index funds with active funds to maximize IRR and diversification when we do not have index funds. The supply of short-term fixed income index funds is very limited at the moment. When this is the case our committee continues to take into consideration the cost of the fund as a very important element in the selection process.

You can see the distributions of the 100% bond portfolios on the corresponding pages:

The inbestMe investment committee periodically reviews the optimal distribution of all portfolios, seeking a balance between return and risk. This review, which is carried out at least once a year in all our portfolios, implies, especially for bond portfolios, paying some attention to the evolution of interest rates.

Rates are expected to peak in late 2023 and begin to decline in 2024, with a possible reset of the inverted yield curve.

However, these forecasts may change with fluctuations in inflation and the economy. Trying to get the timing of the FED or the ECB right with their interest policy is as or more complicated than getting the best time to enter the stock market.

Summary of the Bond Portfolio offering

Bond portfolios in Euros (Profile 0)

| Type/Style | Standard | SRI and green bonds (new) |

| Index Funds Starting at €1,000 | 3.70% net Yield 1.2 years Duration | 3.60% net Yield 1.4 years Duration |

| ETFs Starting at €5,000 | 3,70% TIR 1.1 years Duration | Not available at the moment |

Bond portfolios in Dollars (Profile 0)

| Type/Style | Standard | ISR y bonos verdes (nuevo) |

| ETFs A partir de 5.000€ | 5.10% Yield 1.2 years Duration | Not available at the moment |

Estimated net Yield around 3.70% in Euros

The net Yield of the bond portfolios are around 3.70% in EUROS at the time of writing this post. Below are the detailed calculations of how we get from the gross Yield, which is around 4.24%, to the net Yield(example: standard index funds):

- Estimated Yield of the bond portfolio in Euros: 4.52% gross/ 3.70% net after commissions according to the following calculation:

- Gross Yield of the portfolio: 4.52%

- TER of the funds: 0.38%

- Average management fee: 0.35%

- Custody fee: 0.105%

- Net Yield of the portfolio: 3.70%

These Yields indicate the current average yield (at maturity) of the monetary and bond funds that make up the portfolio weighted by their weight and discounting all the commissions borne by the portfolio: the TER of the funds (0.15% average), the average management fee (0.38%) and maximum custody (0.11%). The annual return of the portfolio may be different.

As you can see in inbestMe we publish the net Yields. When reviewing Yields of other bond portfolios or mutual funds outside of the inbestMe platform, make sure you are comparing Yields net of all fees. We have observed that gross Yields are very often used.

Important note: this Yield is not fixed and will evolve depending on:

- The evolution of interest rates

- Credit risk premiums

- The volatility of financial markets itself

Therefore, the annual profitability does not have to coincide with the Yield of the portfolio.

We will update this Yield monthly on the corresponding page of this portfolio.

Estimated net Yield around 5.1% in Dollars

The Yields in dollars are higher due to the more restrictive monetary policy of the FED. But it is vital to remember that hiring a portfolio in dollars only makes sense if your economy is dollarized or if you want to have part of your assets in dollars. Below are the detailed calculations of how we get from the gross Yield, which is 5.48%, to the net Yield:

- Estimated Yield of the bond portfolio in Dollars: 5.66% gross/5.1% net after commissions according to the following calculation:

- Gross Yieldof the portfolio: 5.66%

- TER of the funds: 0.11%

- Average management fee: 0.35%

- Custody fee: 0.105%

- Net Yield of the portfolio: 5.1%

Important note: this IRR is estimated and is not fixed and will evolve depending on:

- The evolution of interest rates

- Credit risk premiums

- The volatility of financial markets itself

Therefore, the annual profitability does not have to coincide with the Yield of the portfolio.

We will update this Yield monthly on the corresponding page of this portfolio.

Higher net IRRs and lower risk but not exempt

It is important to note that the Yield (in both Euros and Dollars) of the 100% bond portfolio is not a guaranteed IRR (net annualized return). The IRR is an indication of the weighted annualized return (net of commissions) generated by the portfolio of funds that comprise it and does not have to be the return that the portfolio actually obtains, since the value of the funds may vary depending on the evolution of interest rates. Once the relationship between IRR and portfolio profitability has been clarified, at inbestMe we have decided to update and report the net IRR of the 100% bond portfolio at the end of each month.

The advantage that rising interest rates can offer is that now, by incurring less risk, we can obtain a better return than in the past, when rates were at 0% with fixed income.

Although bonds are generally less volatile, they are not risk-free since their value can vary depending on the evolution of interest rates and credit risk premiums, that is, the bond portfolio is subject to a certain volatility. The minimum horizon required to contract a bond portfolio is at least 2 years, although it is better to do so with a horizon of 3 or more years.

If you want a portfolio with little risk, close to 0 volatility and a lower horizon (or indefinite, that is, you don’t know when you are going to need the money) it is better that you consider the inbestMe Savings Portfolios. On the contrary, if you have a savings portfolio and have a minimum horizon of 3 years or more, the bond portfolio may be better for you if you accept some volatility. As always in the world of investing it is a trade-off between profitability (the bond portfolio will tend to be higher) and risk (also higher for the bond portfolio). The higher yield will be more evident when the yield curves normalize, that is, long-term interest rates are clearly higher than short-term ones. If you want to go into more detail about this, read “Which is better, the inbestMe savings portfolio or the bond portfolio?”

Taxation of Bond Portfolios

The inbestMe index fund bond portfolios, being built with accumulation and transferable investment funds, are in themselves more efficient than the purchase of bonds or treasury bills, (or even a deposit) where every time we receive the returns they are It automatically withholds taxes from us. By investing in the inbestMe’s Bond Portfolio we benefit from compound interest also on unearned taxes thanks to tax deferral. When we want to mobilize money in the bond fund portfolio, we can decide to transfer it to another fund portfolio, taking advantage of the transferability of investment funds.

In the ETF portfolios we also use UCITS accumulation ETFs but they do not benefit from the transferability of investment funds.

Of course, in both cases when a withdrawal is made, the capital gains are subject to the payment of taxes, in the funds being withheld at the time of withdrawal, in the ETFs and must be declared in the next personal income tax return.

In short, and as a conclusion after the rate increases, the inbestMe bond portfolio can be interesting for that investor who does not want to be exposed to the volatility of variable income and obtain a reasonable return and take advantage of the advantages of the best tax efficiency.

We must keep in mind that a bond portfolio may not be enough to achieve longer-term goals and protect our money from inflation.

We incorporate the 100% Portfolio of SRI Bonds and Green Bonds

Along with this relaunch, and as a result of our commitment to sustainable investment, we have decided to expand the offering of bond portfolios and from now on offer a Portfolio of SRI Bonds and Green Bonds. This is possible thanks to the expansion of the offer of sustainable funds that has occurred in recent years.

Therefore, starting with this relaunch, our clients will be able to choose between the bond portfolio with standard distribution or, if they have preferences for sustainability, choose the SRI and green bond option.

You can see more about the 100% SRI bond and green bond portfolio version here.

Yields and durations are very similar to the corresponding standard portfolio versions.

Conclusión: Ventajas de las Carteras de Bonos inbestMe (Perfil 0)

As a summary, the advantages of inbestMe’s bond portfolios are:

- Benefit from today’s highest returns

- With a highly diversified portfolio compared to the purchase of an individual bill or bond

- With more efficient tax treatment

- With ease of contracting

- With the option of contracting a standard or sustainable portfolio (SRI)

- And from only €1,000