In compliance with Circular 3/2017, of November 29, of the National Securities Market Commission, on advertising obligations through the website of Investment Services Companies in matters of corporate governance and remuneration policy and which modifies Circular 7/2008, of November 26, of the National Securities Market Commission, on accounting standards, annual accounts and statements of confidential information of Investment Services Companies, Investment Institution Management Companies Collective and Management Companies of Venture Capital Entities, the following information is published on the InbestMe website:

a) The articles of association.

See our corporate bylaws at this link.

b) The regulations and other organizational rules of its governing bodies and, where appropriate, of the committees of the board of directors.

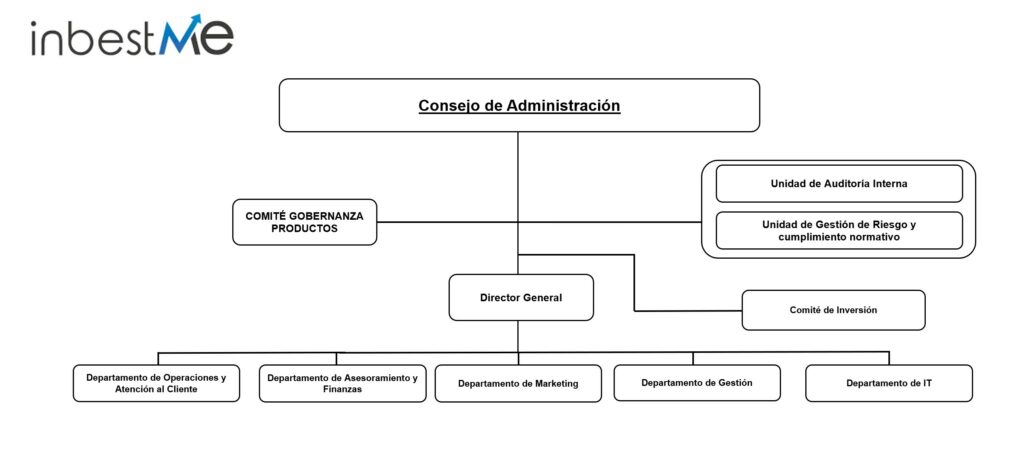

Inbestme’s Board of Directors is ultimately responsible for the implementation of Governance management policies and procedures in the Entity. To this end, it delegates certain functions to the different departments and managers of the Company that carry out the functions of compliance, auditing and risk control and supervision.

The general responsibilities are indicated below, without prejudice to the fact that in the development of the procedure the specific responsibilities of the people involved in each process are established.

Board of Directors

- Establish and maintain an adequate and proportionate organizational structure in accordance with the nature, scale and complexity of the investment and auxiliary services they provide, with well-defined, transparent and coherent lines of responsibilities.

- Establish the business strategy of the Company and its different business areas and ensure that there are human and material resources that guarantee proper management of the business with sufficient segregation of functions and control of the risks assumed.

High Direction

- Define and adopt the necessary measures so that adequate policies and procedures are applied to guarantee that the Company, its managers, its personnel and its agents comply with the obligations contained in the applicable regulations.

- Evaluate and review the effectiveness of the policies, measures and procedures established to comply with the obligations imposed on the Company.

- Adopt measures to address possible recommendations made or deficiencies detected by the Regulatory Compliance and Risk Management and Internal Audit Units.

Regulatory compliance and risk management

- Control and evaluate the adequacy and effectiveness of internal procedures for the detection of risks and the appropriate measures to deal with the deficiencies detected

- Assistance to persons responsible for carrying out investment services in the fulfillment of their duties

- Assess the adequacy and effectiveness of the risk management policy

- Evaluate the degree of compliance by the different areas of Inbestme with the Risk Management Policy.

- Receive the reporting of each area in the event that an incident is observed and inform the council if necessary.

- Collaborate with the Internal Audit unit.

Internal audit

- Evaluation of the operation and effectiveness of regulatory compliance and risk management functions

- Advice to the risk management and regulatory compliance unit

- Examination and evaluation of the adequacy and effectiveness of the procedures and internal control systems implemented by Inbestme

- Prepare an annual report addressed to the Board of Directors

.

c) The organizational structure of the investment services company, the lines of responsibility in decision-making, the distribution of functions in the organization and the criteria for the prevention of conflicts of interest.

In the Conflict of Interest Management Policy of Inbestme Europe A.V., S.A. you can consult the criteria established by the Entity for the prevention of Conflicts of interest.

d) A brief description of the procedures established for the identification, measurement, management, control and internal communication of the risks to which the investment services firm is or may be exposed, as well as a brief description of the internal control mechanisms. of the investment services company, including administrative and accounting procedures

The risk management tools and procedures are in a process of continuous review and improvement, and those currently used are considered appropriate to the nature and level of complexity of the Entity’s activities; Inbestme has qualified personnel who provide sufficient knowledge and experience in risk management and guarantee the evolution and improvement of these management tools and procedures, adapting them to daily practice.

Inbestme has developed a Risk Management Policy and an Internal Control Procedures Manual, both approved by the Board of Directors, which detail all the circumstances and characteristics of the Agency, related to said aspects.

Said policies and manuals are directed without exception to all members of the Board of Directors and to all the people who carry out their activity in the internal structure of Inbestme in the different directions and departments of the Agency, being mandatory knowledge and compliance.

The Company has established a system based on “levels” for the monitoring and control of the risks derived from the investment services and activities of the Agency.

At a first level, they will be the members and managers of each department who, acting in accordance with the Internal Procedures and the guidelines received, will be responsible for compliance with the limits set and report any incident detected to the Risk Management Unit.

At a second level, the person in charge of the Risk Management Unit will assess the level of compliance by the different areas of the Agency with the measures, processes and mechanisms established by the Board of Directors, and their adequacy to the activity actually carried out. issuing reports in this regard when appropriate.

To this end, it will have full power to collect as much information as is necessary from the directors or members of all the departments of the Agency. Once the risks in each case have been evaluated, it will inform the Board of Directors as quickly as each situation requires.

At a third level, the Board of Directors will receive information on the most significant incidents observed in the operation or those that due to their importance and complexity are pending resolution, being also informed regarding the monitoring and resolution of these. Where appropriate, it will adopt the appropriate corrective measures.

f) The composition of the board of directors and the identification of executive, non-executive and independent directors, if applicable.

The Board of Directors at the date of the report is made up of:

- Jordi Mercader Nieto (Director and Chairman)

- Juan José Massó Gil (Non-executive Director and Vice Chairman)

- Joan Albalate García (Non-executive director)

- Tech & Health Investment SLU (Non-executive director)

- Mutual Médica; Mutualidad de Previsión Social a Prima Fija (Non-executive director)

g) Identification of the persons who hold the positions of Chairman of the Board of Directors and CEO. In the event that the same person holds both positions, this circumstance must be indicated.

- Jordi Mercader Nieto (Director and Chairman)

There is no figure of CEO

h) Information on the total remuneration accrued in each fiscal year by the members of the board of directors, reflecting the total figure of the accrued remuneration and an individualized breakdown by remuneration items with reference to the amount of the fixed components and per diems, as well as the variable remuneration concepts. This information will contain any remuneration concept accrued, whatever its nature or the group entity that satisfies it, including the remuneration accrued by the members of the board of directors for their membership of boards in other group companies or investees in which they act in group representation.

The Entity places at your disposal the Solvency Report of the Company, in which you can find, among other aspects, the total remuneration accrued in each financial year by the members of the board of directors.

i) Information on the procedures established to ensure the suitability of the members of the board of directors, general managers and similar, as well as on the mechanisms established to comply with the rules on incompatibilities.

Inbestme has a Procedures Manual for the evaluation of directors and key personnel , approved by its Board of Directors. It includes the policies and procedures that regulate the appointment, dismissal and evaluation of the suitability for the exercise of their position of members of the Board of Directors, general managers or similar, persons who assume internal control functions, as well as other persons who hold key positions for the daily development of the Company’s activity.

All members of the Board of Directors have recognized honor, honesty and integrity, in accordance with the provisions of article 184. bis of the revised text of the Securities Market Law, and have shown personal, commercial and professional conduct that casts no doubt on their ability to perform sound and prudent management of the Entity, in accordance with the provisions of Royal Decree 217 /2008.