Table of contents

ToggleAuthor: Ferad Zyulkyarov

In 2019 inbestMe started to work on novel Artificial Intelligence (AI) based solutions for investment management and optimization. Together with AI Investments (Poland), the University of Oslo (Norway) and the University of Ulm (Germany), InbestMe is a consortium partner in an R&D project “AI Investments – an advanced investment tool based on machine learning and big data” (project number E! 12894).

The total budget of the project is €1.227.342 and is co-funded through Eurostars which is EU’s prestigious programme to support international innovative projects. Eurostars applications pass through a highly-competitive selection process, being scrutinized by a panel of international research and business experts, to ensure that only the best business ideas and strongest partnerships get the support they need.

The contribution to such a project, places InbestMe into the international league of innovating SMEs and makes InbestMe the most innovative roboadvisor in Spain and Europe. In this article we will explain what is and what is not Artificial Intelligence, how Artificial Intelligence is used in roboadvisors and the research line of InbestMe in Artificial Intelligence.

What is Artificial Intelligence?

Artificial Intelligence is the ability of computers, software programs and machines to mimic the humans, how we think and behave. This includes learning from examples and experience, recognizing objects, understanding and responding to language, making decisions, solving problems and combining these and other capabilities to perform functions and activities a human might perform. Example of such functions and activities are playing chess, driving a car, predicting weather forecast, drug discovery and many others.

What is not Artificial Intelligence – example with a robot vacuum cleaner?

Often algorithms that have some simple if-else logic or implement an automatization for repetitive tasks are wrongly labeled as an Artificial Intelligence solution. That in many cases is done deliberately as a marketing trick because it sounds cool and helps selling the product.

Let’s demonstrate what is and what is not considered to be AI with a simple example using a robot vacuum cleaner (like iRobot Roomba), something that many of us have in our homes. Based on how the vacuum cleaner discovers the space and the furniture in the room the vacuum cleaner can be considered as:

- Pre-programmed (not AI)

- Not smart (not AI)

- Smart (AI)

Pre-programmed (not AI)

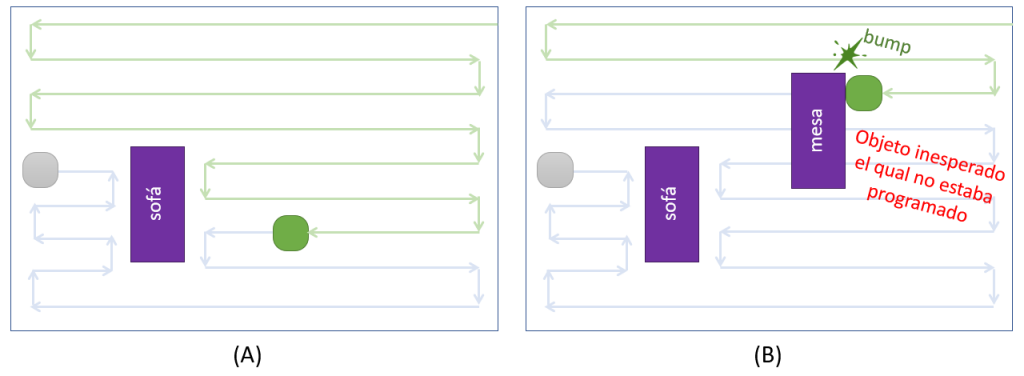

A vacuum cleaner can be programmed to clean a room with a specific shape and layout of furniture inside the room. In other words, the space layout is pre-programmed. For example, in Figure 1 (A), there is a room with a sofa inside. The robot will know the exact location of the sofa and will clean around it without hitting it. If you remove the sofa, the robot will not discover that the sofa is not there and will continue skipping cleaning the location of the sofa. This solution is not considered AI because the robot does not learn itself the layout of the room. Such vacuum cleaners cannot be used to clean rooms with a different layout (Figure 1 (B)).

Not smart (not AI)

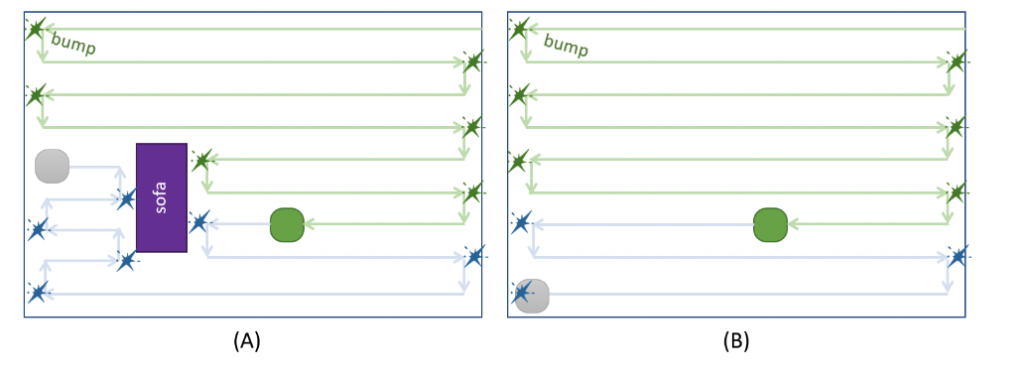

The vacuum cleaner robots that we can buy are not pre-programmed with the layout of our homes. Simply it is not possible to know the layout of every room. There are infinite number of combinations. Instead robots can use a very simple algorithm to clean the entire space of the room. For example, the algorithm can be: if the vacuum cleaner hits an object then it changes direction. Figure 2 (A) illustrates how a vacuum cleaner can clean the entire space of the room. When it hits an object such as the sofa or the wall it changes the direction. If we remove the sofa (Figure 2 (B)), in a new cleaning cycle, the robot will discover the new space and clean it.

This simple algorithm is not AI because it does not learn and remember the position of the sofa. As a result, when it makes a second cleaning pass it will hit again the sofa. An enhancement of this algorithm would build and store the layout of the room into the memory of the robot. In this way the robot will not hit the sofa. Still this is not considered to be AI because the acquired knowledge is not used to improve the space discovery.

Smart (AI)

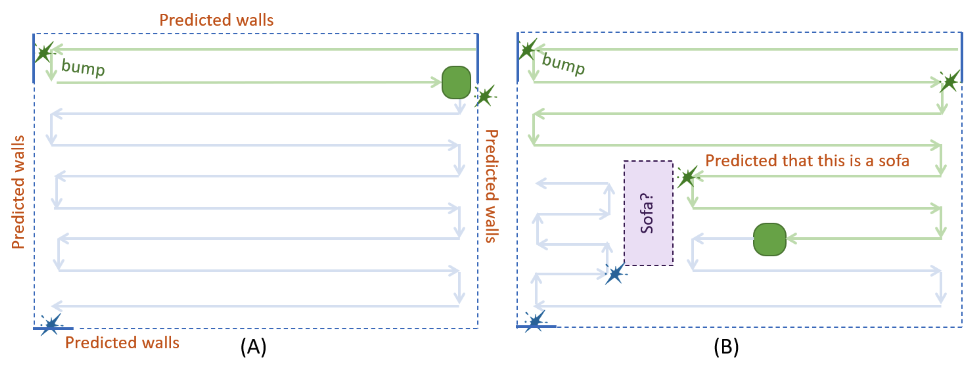

A smart robot that uses AI would go beyond building a virtual map and predict the layout of the room and the shape of the objects inside the room. For example, when the robot hits the wall few times it will detect that the walls are straight lines and calculate the angle between the walls.

Then it will predict and construct the layout out of the room (where the walls intersect) without continuously hitting across the entire length of the walls (Figure 3). More complex AI algorithms would be able to discover the shapes and the location of the objects inside the room. The discovery of each new shape will require the robot fewer hits because it will learn and apply its object discovery knowledge. This is exactly what we humans do. We learn doing things better.

As a side comment, by observing how my robot vacuum cleaner discovers the space, I would say it is not smart and does not use AI. As a disclaimer my robot is not Roomba but is a major brand with a price tag of 450€ purchased in 2017.

Do Roboadvisors use Artificial Intelligence?

Most roboadvisors are not intelligent, or in other words they do not use any AI.

Roboadvisors, as the name implies, are robots that advice or recommend an investment portfolio. Besides recommending an investment portfolio, roboadvisors like InbestMe, also manage the investment by creating BUY/SELL orders and executing these orders.

Most roboadvisors are not intelligent, or in other words they do not use any AI. I would challenge the roboadvisors that claim so to provide more information about their AI solutions.

Typically, roboadvisors like InbestMe, advice their clients by recommending an investment portfolio with a specific risk/return score, for example 6 out of 10. This advice is based on the answers that a client provides during the account opening. Typically, this score is determined through an algorithm that cannot be considered as AI. If we classify the advice algorithm of the roboadvisors it would fall into the category the “Not smart (not AI)” for the robot vacuum cleaner.

However, roboadvisors are ideal robots, because for them it does not matter if they advise 1 client or 100.000 clients by applying the same algorithm again and again. In similar way, they are also very good in managing portfolios. For a roboadvisor there is no difference if it manages 1 portfolio or 100.000 portfolios. Typically, roboadvisors are pre-programmed what the distribution of each portfolio should be (like in the example of a robot vacuum cleaner with the pre-programmed space). Then periodically, for example once a day, the roboadvisors execute a re-balancing operation to make sure that all the portfolios are aligned with their expected distribution.

Artificial Intelligence in finance

Artificial Intelligence is disrupting the businesses and challenging the traditional values in the financial sector. Example, applications of AI in finance are:

- Portfolio optimization – improve the performance of an investment portfolio

- Market forecasting – predict the price

- Portfolio recommendation – recommend a portfolio to an investor

- Credit score – identify the credit score for a client

- Risk score – predict the risk score for a share

- Fraud detection – detect if a transaction is fraudulent

Artificial Intelligence at InbestMe

Would you trust an Artificial Intelligence algorithm invest your money?

InbestMe works on Artificial Intelligence based solution for optimizing investment portfolios. In simple words this means, we research & develop algorithms that will be able to learn how to adjust the portfolio distributions in such a way that the portfolio will have a better performance based on a set of metrics.

At the moment the composition and the distribution of our portfolios is defined by InbestMe’s investment committee, who are experts in finance. The InbestMe Dynamic portfolios are already adjusted automatically based on algorithms. These algorithms are close to Artificial Intelligence because they learn but still cannot be considered Artificial Intelligence because they don’t predict or improve their accuracy by learning. For the past 1,5 years we have done a significant process in studying and developing various AI algorithms that would further enhance InbestMe’s portfolio management algorithms to both predict and improve their accuracy as they learn.

Besides, portfolio optimization, we have also done studies about how to apply AI in advising our clients about what is the most appropriate portfolio for them. The study was mostly focused on existing clients and updating their profile and portfolios based on the changing market conditions as well as the client’s economic and financial situation. We will provide more information about our AI work in separate articles. Stay tuned and let as know what do you think. Would you trust an Artificial Intelligence algorithm invest your money?