As we explained in our presentation, the inbestMe Savings Portfolios are designed to automatically take advantage of interest rate hikes by central banks.

As we reported in mid-June 2023, the European Central Bank (ECB) decided to raise interest rates by 0.25%.

In addition, the ECB anticipated that with inflation so far above the 2% target, the central bank’s monetary policy will remain tight, meaning that there will likely be further rises.

The yield of the Euro Savings Portfolio rises to 3%.

As a consequence of this increase as of June 30, the yield (variable) or annualized yield as of this date, automatically rises to 3%.

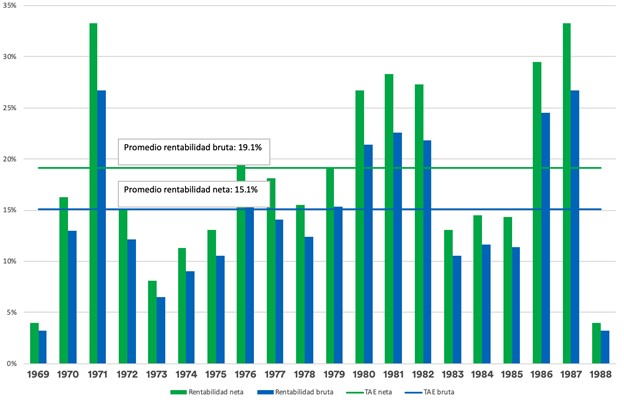

As can be seen in the chart above, this is the fifth increase since November 2022, in line with the promise that this evolves with official rate hikes.

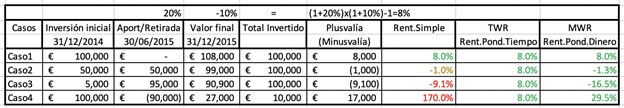

You may be interested in remembering how we calculate the variable yield of the Savings Portfolio.

And if you want to go even deeper, see the estimated variable yield of the Euro Savings Portfolio 2023/2025.

Ten times higher than deposit rates

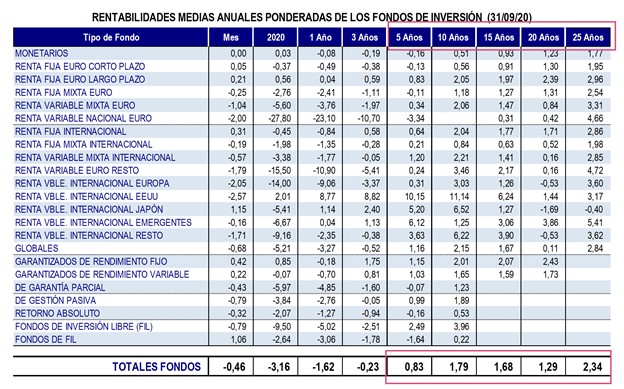

According to Bank of Spain statistics, interest rates on deposits in Spain as of April 2023, the latest available data, was 0.3% as shown in the graph below.

This means that right now the yield (variable) of the Euro Savings Portfolio is 10 times higher than the average of the deposits offered by banks in Spain.

We can see in the graph above, how the yield of the Savings Portfolio (interleaved on the BdE graph) does evolve rapidly with interest rate rises, covering the spread that your bank (as a rule) does not offer you.

Banks have been quick to raise rates on loans but not on deposits

While deposit rates have hardly been raised, the situation for loans and credits is radically different.

As we can see in the same graph from the Bank of Spain, banks have rapidly raised the average APR on loans and credits to 5%, almost multiplying by 3 the level of rates (which was around 1.75%).

Let us remember that for banks our money is their raw material, and they try to get the highest possible margin from it, charging the maximum for the money they lend while paying the minimum for it.

This is totally legal: the main function of credit institutions (and very important for the economy of a country) is to facilitate credit and do business with it.

It is also lawful and advisable that you as a client look for the best options for your savings, and we believe that there are few options as efficient for your savings or your (emergency fund) as the Savings Portfolio that we summarize here again:

The inbestMe Savings Portfolio is part of what we call the virtuous quadrant of personal financial planning.