inbestMe Savings Portfolio are designed to automatically take advantage of interest rate hikes by central banks. What are you waiting to open Saving Portfolio?

The FED and the ECB raised their rates 0.25% and 0. 50%

As we reported a few days ago, the FED raised by 0.25% and the ECB raised by 0.50% its official interest rates during March 2023.

That is why the yields (variable) of our Savings Portfolios will go up as of 3/30/2023 to:

- 2.40% yield for Euro-denominated portfolios (previously 1.90%)

- 4.30% yield for dollar-denominated portfolios (previously 4.00%)

If you want to learn more, you can read how we calculate and communicate changes in the yields (variable) of Savings Portfolios.

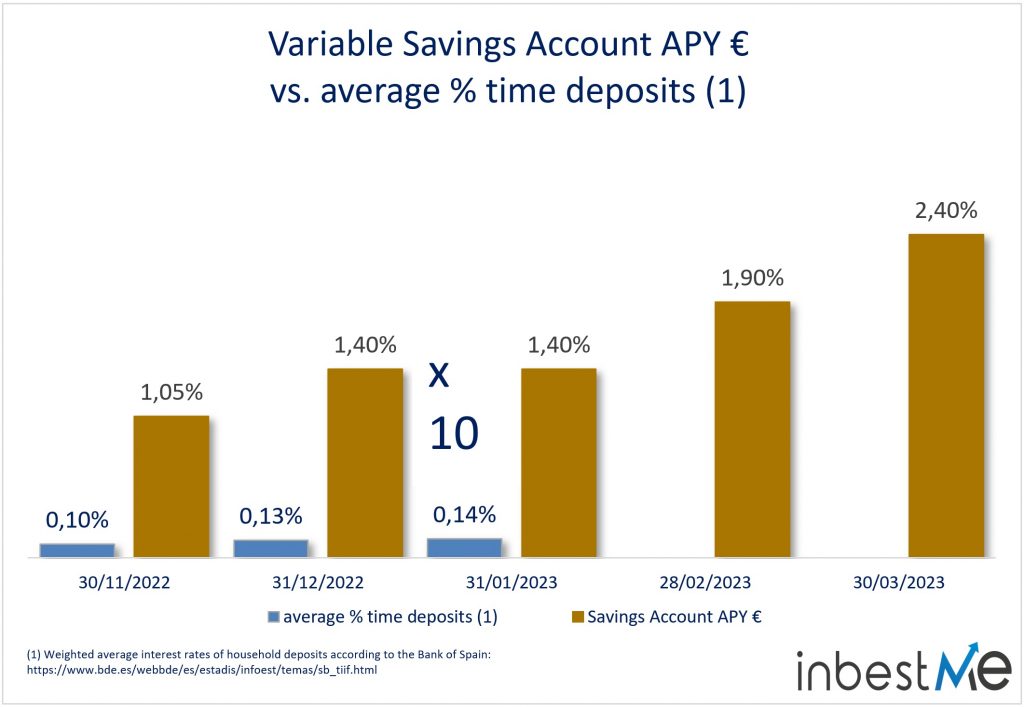

The 2.40% yield of the inbestMe Savings Portfolio is 10 times higher than the average bank deposit rate.

For the time being, it is clear that the strategy of raising interest rates on deposits in banks is being very slow.

Let’s remember that the Savings Portfolio is not a bank deposit, it is different. We have already analyzed which is better, a bank deposit or a Savings Portfolio. One of the great advantages is that the yield (variable) of our Savings Portfolio adapts to the increases of the official rates of the central banks in a few days. And this makes it very competitive.

As we can see in the graph above, in the last available comparison (January 2023) the yield (variable) of our Euro Savings Portfolio was 10 times higher than the weighted average interest rate applied to bank deposits (according to Bank of Spain statistics). We believe that this multiple will always be very favorable to our clients for the above-mentioned reasons.

Why does the inbestMe Savings Portfolio have such a high yield compared to average deposit rates? Because inbestMe is not a bank, and this is better for you.

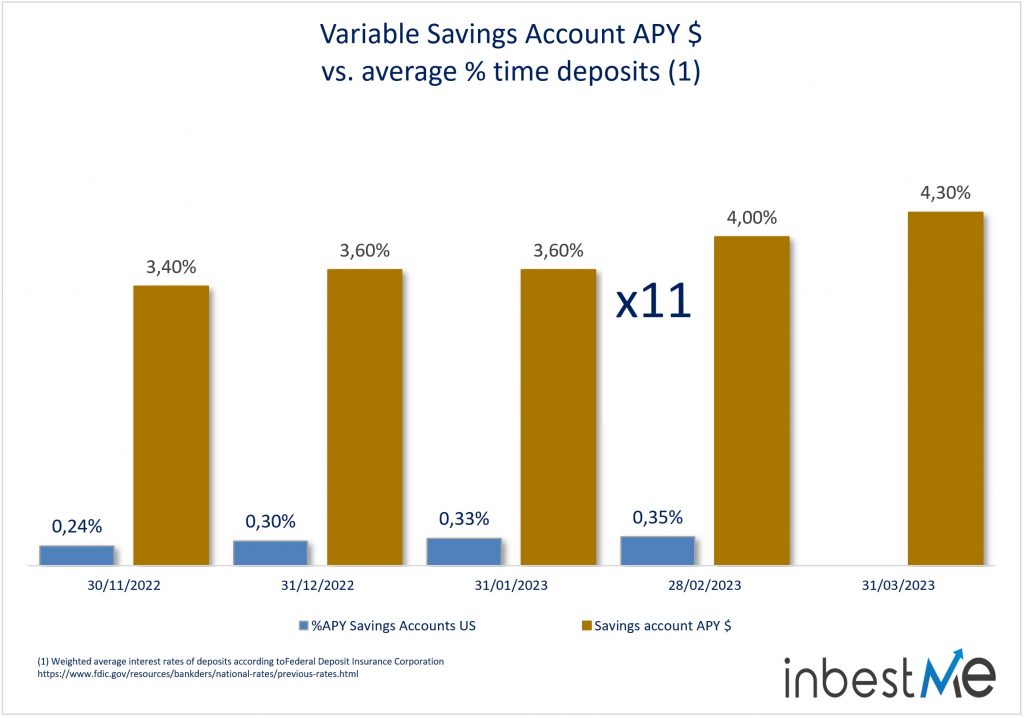

4.30% in $ is 11 times higher than average rate

The saver who accesses a Savings Portfolio in dollars must remember that if it is not his or her main currency, he or she may be exposed to exchange rate risk.

But, on the other hand, some savers, either because they invoice or are paid in dollars or because they work abroad and therefore have a more international perspective of their assets, or simply because they want to have some exposure to dollars, decide to open a Savings Portfolio in dollars at inbestMe which now gives a very high interest rate, as the official interest rates in the US are also higher than in the EU.

There are no statistics on dollar deposits in Spain or in general in Europe. There are several websites in the USA that track this type of accounts.

As we can see in the graph above, in the last available comparison (February 2023) the 4.00% yield (variable) of the inbestMe Dollar Savings Portfolio was 11 times higher than the average yield of Savings Portfolios in the US, according to the Federal Deposit Insurance Corporation (FDIC or equivalent to the Deposit Guarantee Fund). Probably in March and after the increase to 4.30% this multiple will be similar.

Savings Portfolio yield covers the difference

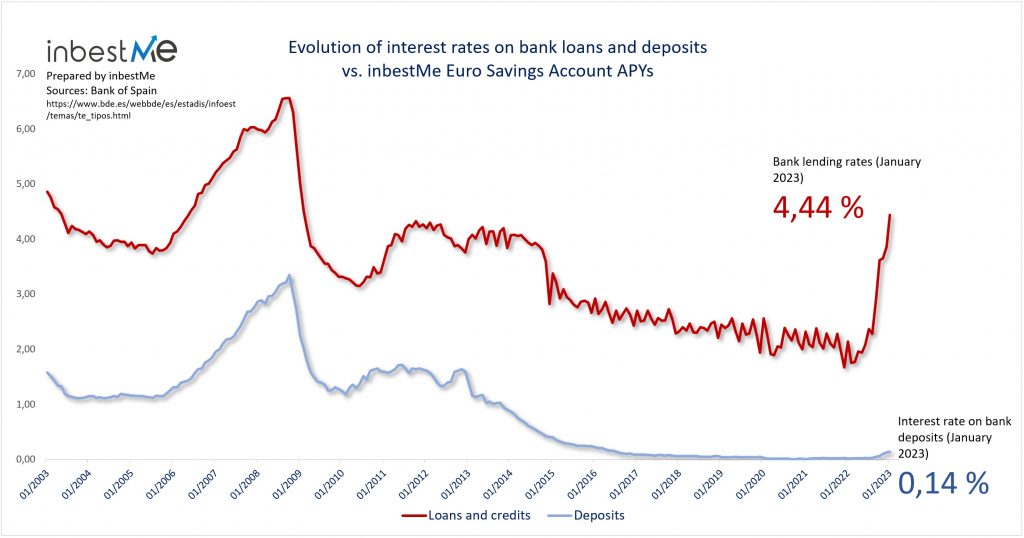

It has been many years since we have seen such high official interest rates.

As we can see in the graph, we would have to go back to the years before the financial crisis to see similar rates. We can also see that deposit rates are rising very slowly.

Banks are reluctant to raise deposit rates for their customers for obvious reasons: they want to limit as much as possible the transfer of part of what they earn from lending by remunerating their deposits.

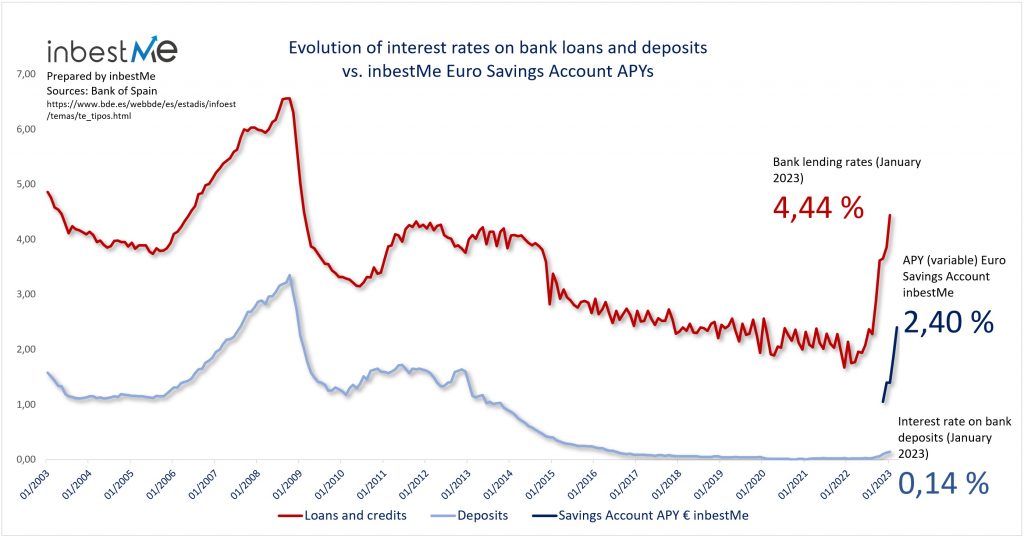

We can clearly see this in the above graph prepared with data from the Bank of Spain: the average interest rate on loans has already risen to 4.44% while the average interest rate on bank deposits has barely risen to 0.14%.

To understand this we must first know what is the main source of banks with a focus on commercial and consumer-oriented banking. Banks are the only institutions authorized to raise money (without consideration) and charge for loans. The remuneration of the money we deposit in the bank is optional, and since the financial crisis we have become accustomed to this remuneration being zero.

In other words, (commercial) banks use our deposits to make loans. There is nothing wrong with that, this is what banks were created for.

That is, their margins and profits are mainly determined by the interest on loans to consumers. These loans can be mortgages (adjusted rates), consumer loans, including when we use the credit card with deferred payments (higher rates). The margin, and therefore much of the profit a bank earns, is the difference between the interest it charges on loans minus the interest it pays (if it pays on its deposits).

For a bank, the money it collects from its customers (and other sources) is its raw material. The lower the cost of the money, the higher its margin potentially and its profit, if it manages to place it in the form of loans.

Moreover, it is likely that this time they will be even more reluctant to raise them because of their experiences during the great financial crisis. Also, because of the recent mini banking crisis in the U.S. and in Switzerland with Crédit Suisse that has disappeared.

In the graph above we have inserted on the graph above the evolution of the yield (variable) which is rising at the same rate as the central bank increases and if rates continue to rise even if you pay more for your mortgage, at least you will receive a higher return on your savings, the Savings Portfolio yield covers the difference.

Do not wait for your bank to remunerate your deposits, it will probably take some time to do so and if it does, it will do so as little as possible.

With the inbestMe Savings Portfolios, you don’t have to go “hunting” for the best deposit. Most of the time the profitability of our account will be among the best. As it is not a bank deposit, but better, it is totally flexible to add or withdraw money. Our account is not subject to a time limit and is tax efficient.

In this link, you can consult the updated yield of the Savings Portfolios.