During the last few days, one important US bank was closed. It was all stunningly quick. Silicon Valley bank was considered one of the best US banks. In just a couple of days it failed, and it was the biggest banking failure of the last 15 years and the second ever.

Let’s see how events unfolded.

What happened to SVB?

It all started with the collapse of Silvergate, whose core business was to offer banking services to cryptocurrency platforms such as Coinbase and FTX for example.

At the end of last September, Silvergate held about 12 billion dollars of deposits linked to the crypto business. These funds had been invested not in short-term government bonds but in longer-term treasuries, mortgage backed securities, municipal Bonds and real estate loans. Then came the FTX scandal, and many investors closed their accounts for contagion fears.

Many of these accounts were deposited at Silvergate which then experienced a hemorrhage of deposits. In order to meet the funding requirements, the bank had to liquidate its securities portfolio. The rise in yields over the last period had led to a significant drop in the value of these bonds, the sale of which resulted in a loss of about 880 million dollars. These losses led to the closure of the bank and its liquidation.

The pressure then shifted to Silicon Valley Bank (SVB), which was the bank of Silicon Valley start-ups to which it offered banking services such as deposits, loans, cash management, etc. The explosion of funding by venture capital companies in 2020 and 2021 had flooded these companies with cash was held in deposits, often with SVB.

The abundance of cash for these start-ups, which typically burn cash, has been shrinking over the past year in coincidence with some factors such as shrinking valuations, declining IPOs and a reduced flow of finance from venture capital companies.

These companies have then retired money from their deposits and, to fulfil these requests, also SVB had to liquidate its portfolio of securities incurring in important losses estimated in the order of 1.8 billion dollars as apparently very little or no hedging had been made by the bank against higher interest rates.

The bank attempted a $2.25 billion capital increase, but it did not succeed. A last minute sale was also attempted, but it was also aborted, and the regulator ordered the closure of the bank.

We would like to take this opportunity to inform you that the exposure of our portfolios to the SVB is very small, representing only 0.018% of the weight of the S&P 500. The maximum exposure (profile 10) would therefore be 0.004%.

Extreme measures in the USA

This is the second-largest bank failure in the US since Washington Mutual in 2008. By the end of 2022, SVB had $209 billion in assets and was the country’s 16th largest bank.

Another bank, Signature Bank, was closed over the weekend by New York authorities.

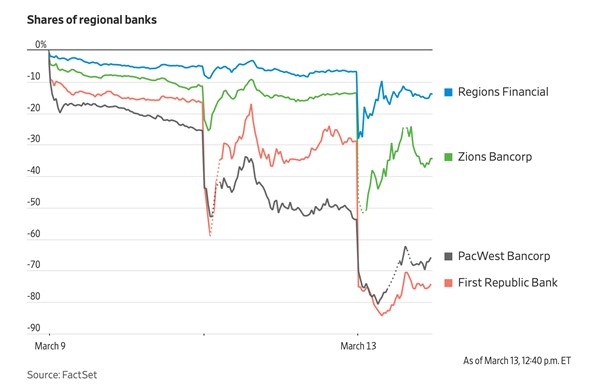

The danger was a spread of the contagion to all the financial sector. So, the Federal Reserve and the Treasury, before markets reopening on Monday, announced a new set of measures to avoid the worst.

Basically they decided to backstop all depositors, also those above 250k that are usually not guaranteed by the FDIC.

Also, they decided to set up a separate facility that will provide loans up to one year for institutions affected. These institutions can get the financing presenting bonds as a guarantee, and they will get the equivalent of 100 even if the bond price is lower due to the increase in interest rates.

The effect of these measures was to provide a safety net for the banking sector. On the other side, it involved a huge repricing of the expectations regarding the future decisions of monetary policy. In fact, if the central bank is forced to save banks because of the losses originated on bonds, it becomes less likely that it will decide to hike rates further, pushing bond prices even lower.

The peak in official interest rates was priced last week at 5.60%. On Monday, the official rates are expected to reach 4.80% as the highest level.

All in all, most of the problems originated from the fact that clients wanted their funds back. It has to be stressed that SVB had a very poorly diversified base of deposits. They were basically deposits from the same type of innovative companies that started to withdraw money all at the same time when financing conditions became tougher.

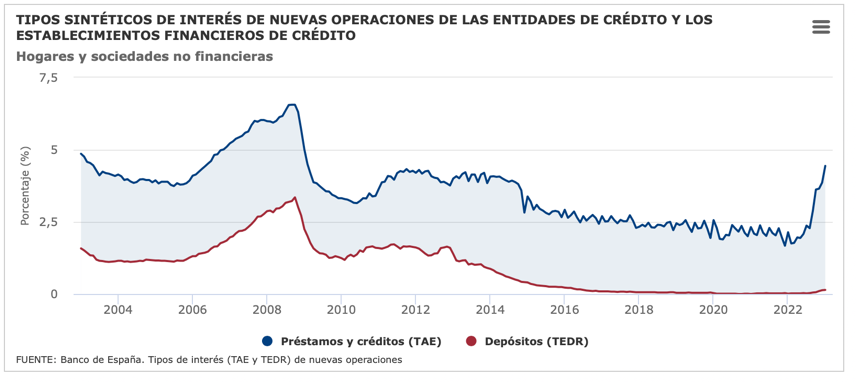

Bigger banks have a better diversified base of deposits, and bank runs such as the one occurred to SVB are much less likely. It has to be said anyway that banks have been extremely reluctant to increase the rate they pay to clients in their accounts, and this has made them not very competitive in attracting deposits.

Basically, almost all banks pay a deposit rate very close to zero, even if official rates are much higher. This has increased their marginality, that has however come at the detriment of the real return obtained by clients in this period of high inflation.

Alternatives to bank deposits

In contrast to bank deposits, at inbestMe we offer a way to obtain a competitive return with very low risk with our Savings Accounts. Right now, the profitability of our savings account is 10 times higher than the average of new bank deposits in Spain (according to the graph above).

After the last increase, you can get 1.90% on Euro portfolios and 4% on Dollar portfolios. The APY is variable, linked to the expected increases in central bank interest rates. You can see in detail why the inbestMe savings account is generally better than a bank deposit.

As far as security issues are concerned, the main difference of our savings accounts is that they are precisely not a bank deposit with a bank IBAN. In other words, they are not deposits that are part of inbestMe’s balance sheet or directly part of any balance in a bank or financial institution.

inbestMe savings accounts are made up of at least two money market funds from the world’s leading fund managers (such as Blackrock, Pictet, Amundi, BNP Paribas…). The category of the money market funds is 1 out of 7 (the lowest risk in a mutual fund).

In turn, these funds can hold up to 200 positions between very short-term bonds, treasury bills, certificates of deposit, etc. Combining the two money market funds implicitly is like having positions in 400 different assets, infinitely reducing the risk of bankruptcy.

The coverage of the savings accounts, as for all our investment accounts, as they are securities accounts, are not those of the deposit guarantee fund, but those corresponding to an investment portfolio. These are guaranteed in Spain by the FOGAIN (Investment Guarantee Fund) although the amount is the same up to €100,000.