During the years that followed the great financial crisis of 2008, investors faced increasing challenges in understanding the economic cycle and, even more, in deciphering the trend of stock markets and inflation.

This is due in large part to the pervasive role that central banks and governments assumed to avoid the worst in 2008 and to the fact that we never achieved a full normalization in which market laws could restart to operate normally.

In particular, many times the behavior of financial markets seemed not to reflect economic or company fundamentals. As mentioned above, this is partly due to central banks interventions, but too often we forget the fact that markets and economy are not the same thing. In particular, there are some asyncronies between the movements of markets, economy, inflation, and interest rates that are too often forgotten.

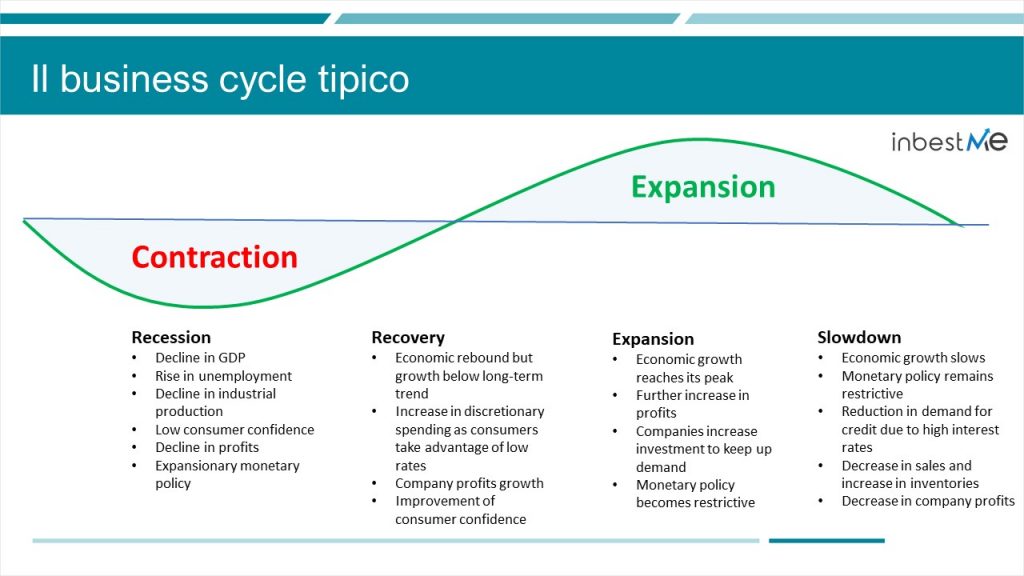

The typical economic cycle

Figure below shows the four phases in which an economic cycle is usually divided: recession, recovery, expansion, slowdown.

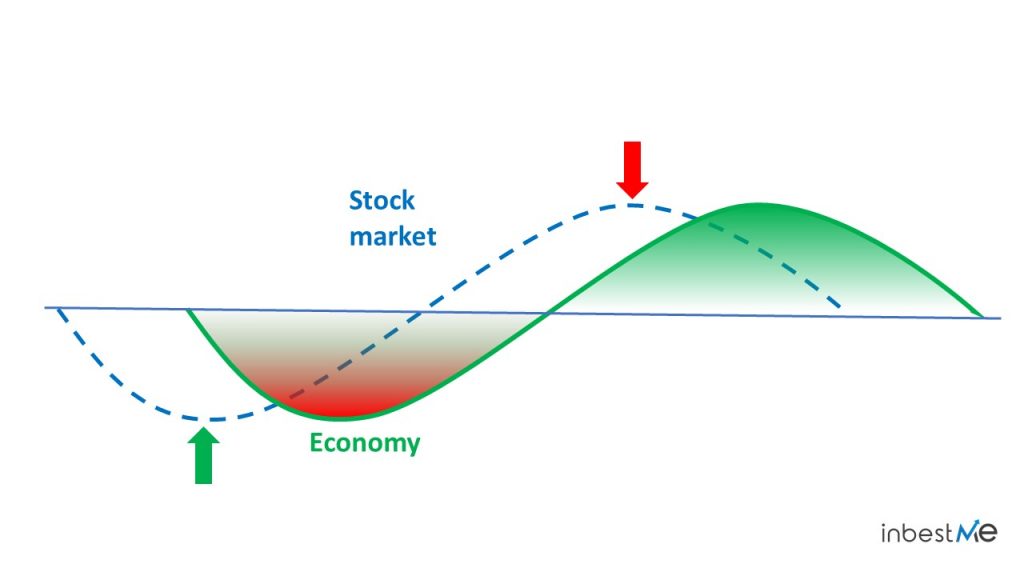

The economic cycle is often referred to as the same thing as the stock market, meaning that when the economy slows down the stock market should fall while when the economy grows the stock market should rise.

We must always remember, however, that the economy and the markets are not the same thing and that there can be considerable discrepancies between the two.

In particular, the stock market tends to anticipate the economy by a few months. This means that the stock market finds a bottom when the economic picture is still negative, while it begins to fall when everything seems to be going well for the economy.

In other words, the stock market doesn’t wait for good news to rise and doesn’t wait for bad news to come down. This is often very difficult for investors to understand.

Let’s look how this works in the real world. The graph below shows the index S&P 500. In grey are the periods of recession. In the lower part of the graph is shown the index return during the last 12 months.

As it can be seen, usually the 1-year return turns negative before the recession starts, meaning that the stock markets anticipates the recession, and often turns positive before the recession ends.

That is why getting out of the stock market when the economy is bad and waiting that it is all clear to get back in usually does not work, as the market might be already 20% higher. Good news and bad news tend in fact to be discounted in advance by the market.

Why the stock market tends to anticipate the economy?

There are at least three reasons:

1) First, generally the collective knowledge of a group is always greater than that of the brightest of its members. Famous, in this regard, Galton’s experiment on the wisdom of crowds.

2) Secondly, it can sometimes be a self-fulfilling prophecy where the descent or ascent of markets actually aggravates or improves the condition of the economy in a phenomenon that is sometimes referred to as reflexivity.

3) Thirdly, the so-called wealth effect could operate, which, with the rise of the markets, makes individuals and families richer and more able to spend, thus supporting economic recovery, and vice versa.

The economy leads inflation and interest rates

That between the stock market and the economy is not, however, the only asynchrony that exists.

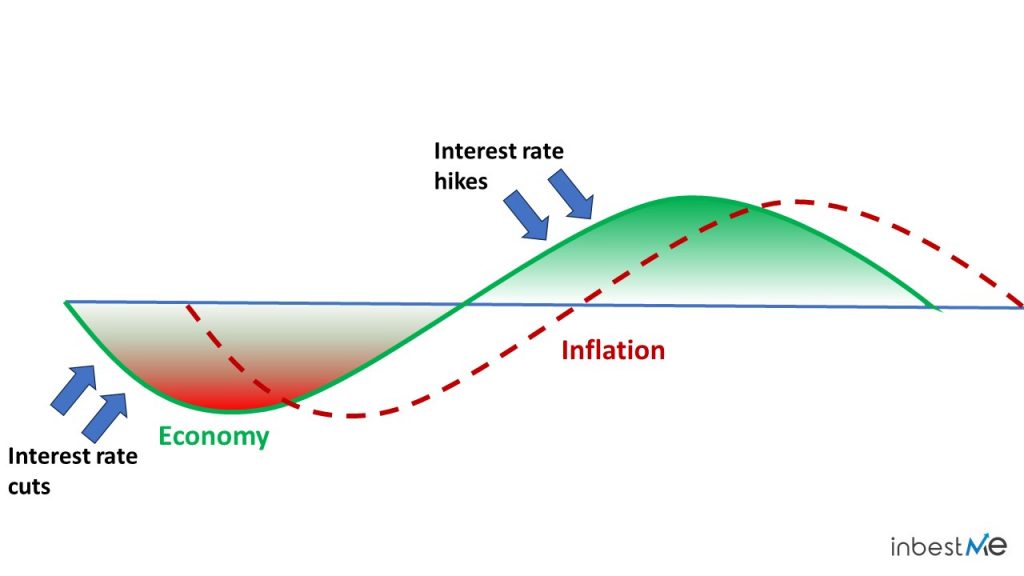

If the markets anticipate the economy, however, the economy anticipates inflation and interest rates.

Indeed, the start of the economic recovery does not immediately lead to inflationary pressures and, for its part, the central bank will want to be sure that the economy is indeed accelerating before increasing interest rates. Inflation and rates then begin to rise at a more mature stage of the recovery.

Similarly, inflation and rates do not begin to fall when the economy reaches its maximum expansion but at a later stage of the slowdown. Here, too, before lowering rates, the central bank will want to have some confidence that the economy is indeed slowing down and that upward price pressures are decreasing.

These asynchronies have a decisive impact on the performance of different financial assets throughout the business cycle.

In particular, bonds will tend to overperform during the cycle of falling interest rates; stocks will start to rise before the economy bottoms but will start to fall when the economy is still growing; inflation sensitive assets such as the commodities will start to do well at an advanced stage of the recovery when demand and inflation pick up and will perform until a late stage of the expansion.

Therefore, the best strategy for positive long-term performance is generally not trying to time the market, but to build a well-diversified portfolio, with different types of assets, that fits our financial objectives and risk profile.

Artículos relacionados:

Russia – Ukraine conflict: first news

Russia – Ukraine conflict: first news

Russia’s conflict: Exposure of inbestMe portfolios

Russia’s conflict: Exposure of inbestMe portfolios

Savings Portfolio yields (variable) rise to 1.90% in € and 4.00% in $

Savings Portfolio yields (variable) rise to 1.90% in € and 4.00% in $

What is going on with US banks?

What is going on with US banks?

The Federal Reserve raises interest rates by 0.25% and the yield of our Savings Portfolio also increase to 4.30%

The Federal Reserve raises interest rates by 0.25% and the yield of our Savings Portfolio also increase to 4.30%