Recently, we have had some queries or comments about the global impact investment fund that we incorporated into our SRI index fund portfolios. More specifically, these queries are related to whether this incorporation has been timely.

It is a fact that this fund has not done well since its inclusion (November 2021). What has happened is that global impact investing, in general, has not done well during this period, as we will see below.

At inbestMe, in general, we did not change the distribution of our portfolios for the short term, quite the contrary.

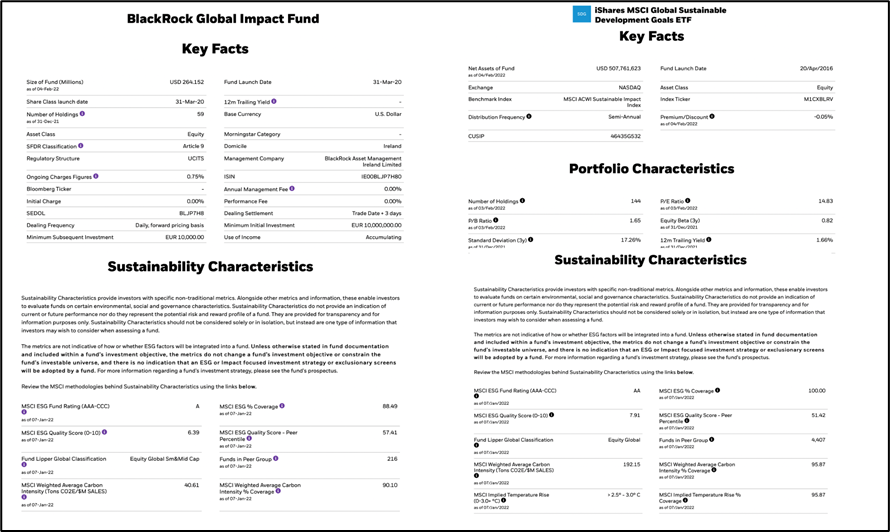

As we explained at that time, the main reason for adding the BlackRock Global Impact Fund I Acc (Eur Hedged). An active fund, was to fill a gap in our SRI index fund portfolios because there is no index fund with its characteristics.

On the one hand, we want to confirm our commitment to indexing. It is undoubtedly the best option for designing very efficient portfolios in terms of the risk/return ratio.

However, on the other hand, we also have an implicit commitment to our clients who have decided to trust inbestMe for sustainable portfolios and to maximize the degree of sustainability of our portfolios.

In a survey conducted among our clients. We confirmed the conviction we already had: a client concerned about sustainability thinks more about impact investing than exclusion and ESG filtering.

Table of contents

ToggleRecent global impact performance

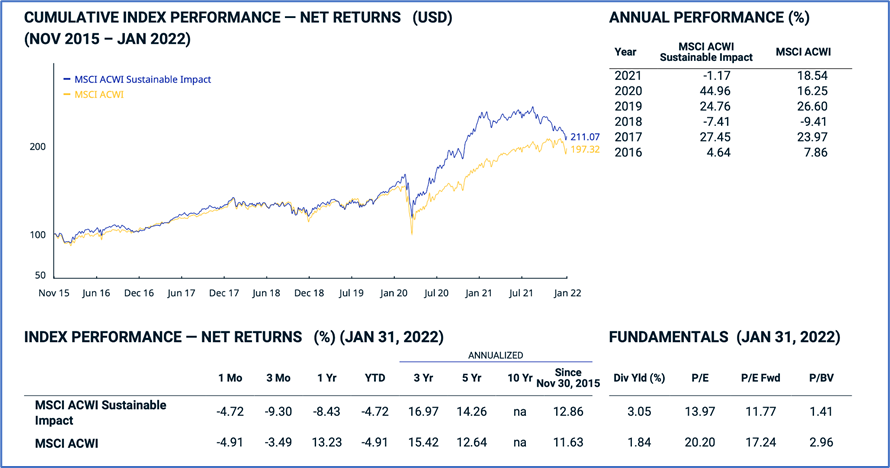

Since the MSCI ACWI Sustainable impact Index has been in existence (November 2015) it (at 12.9%) has outperformed the MSCI ACWI index (11.6%) by 1.3 percentage points.

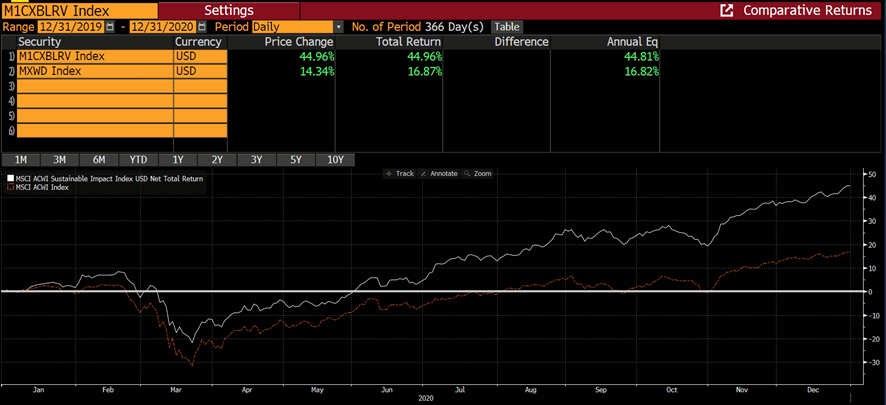

As we can see in the graph below, the MSCI ACWI Sustainable impact Index had an excellent performance during 2020 and part of 2021, clearly outperforming the MSCI ACWI.

During 2020 it obtained a return of almost 45%, well above the 16.8% of the MSCI ACWI.

During part of the year 2021 and at the close of January 2022, the trend has been the opposite

The world sustainable impact index, has fallen by 5.8% while the MSCI ACWI. Despite widespread falls in January 2022, continues to gain 15.9% over this period.

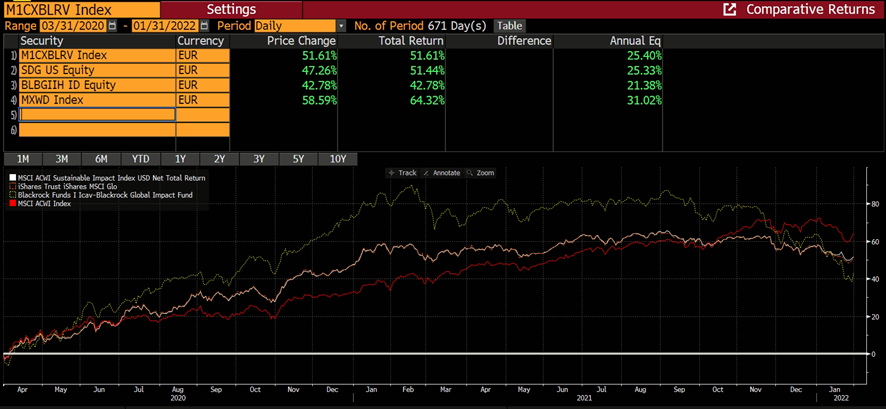

This worse performance has carried over. As we see in the chart below, the iShares MSCI Global impact ETF which tracks this index and which we use in SRI ETF portfolios.

The BlackRock Global Impact Fund I Acc Eur Hedged, aforementioned fund that we added in November 2021 and which does not track this index, has still had a worse relative performance.

Even so, both have accumulated a 51.4% (25.3% APR) and 42.8% (21.4% APR) return respectively since March 2020.

However, both have lost all the advantage acquired in previous months, compared to the MSCI ACWI which in the same period has accumulated 64% (31% AER).

Let’s keep in mind that the global impact fund/ETF is a “piece” of the portfolio’s gearing, like a player in a soccer team.

This is one of the advantages of diversification: the risk of some asset classes is offset by the risk of others thanks to their de-correlation, reducing the overall risk of a portfolio.

The long-term average expected returns of our portfolios already take into account different scenarios.

The weight of the global impact fund/ETF in the portfolios is related to the risk profile.

In the highest profile (profile 10), let us remember the most extreme and where the investor is already accepting to bear higher volatility in exchange for higher returns, the fund/ETF weighs around 10%. So it would be “subtracting” a maximum of 1.5% in this period.

On the other hand, in a profile 5 (a more balanced portfolio), the performance of this fund “subtracts” 0.75% from the overall portfolio, since its weight is around 5%.

We have put “subtract” in quotation marks because, thanks to the diversification of our portfolios, this “negative effect” has hardly been perceived. In fact, our SRI portfolios are among the best in 2021 and cumulatively since their inception.

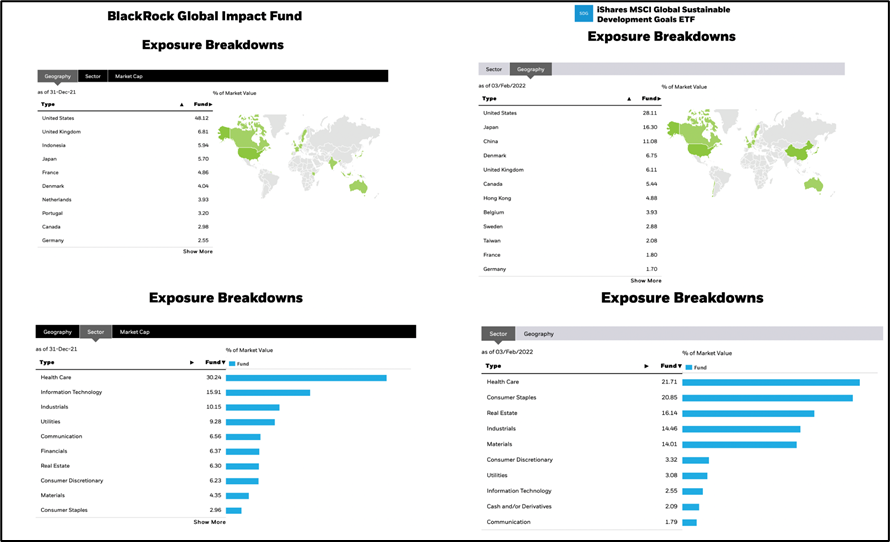

Sustainability, even if indexed, implies deviating from the main indexes.

Being sustainable implies in one way or another. Excluding, filtering in terms of ESG and selecting and investing within the world indexes in companies that sell or provide services that have a positive impact on one of the Sustainable Development Goals.

This, even if we do it through indexes, (with the exception mentioned above) implies moving away from the main indexes. We think it is obvious, this is what is behind the words exclude, filter, select.

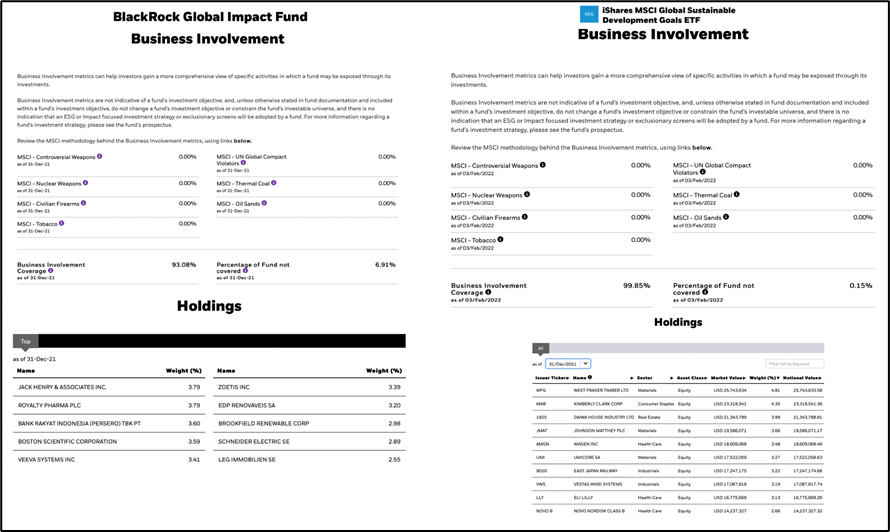

More specifically, the MSCI ACWI Sustainable Impact invests in about 150 companies while the MSCI ACWI invests in almost 3,000 companies.

The BlackRock Global Impact Fund I Acc (Eur Hedged) is even more selective: it aims to hold between 40 and 60 companies.

In designing its portfolios, this is what inbestMe has sought to do. To go as far as the ESG indices allow us to go in terms of sustainability. Selecting best-in-class and impact companies, and when not, to use alternatives to be consistent with our own values and the sustainability surveys we conduct with our clients.

We measured our SRI portfolios (2015) they have performed relatively better against standard indexed portfolios.

But this will not always be the case and even less so if we analyse only a few months, as is the case (November 2021 to January 2022 is just 3 months).

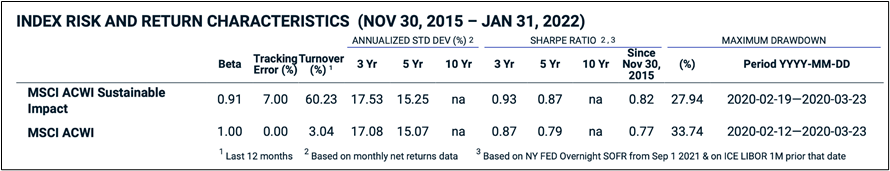

The data available from MSCI show that the sustainable impact index is, for the moment, more efficient according to the Sharpe ratio obtaining 0.82 versus 0.79 of the MSCI ACWI and has suffered more moderate maximum falls, 27.9% versus 33.7%.

As for the fund, Blackrock Global Impact Fund I Acc, since it was launched more recently (March 2020), we have less historical information: the one-year information shows a somewhat higher degree of volatility.

So, we have commented on other occasions and repeatedly that we believe that the investment will either be sustainable, or it will not be… over time. We believe that socially responsible investing is here to stay, will become increasingly efficient (TERs are sure to fall) and options will multiply.

Also, believe that it is one of the most important and long-term megatrends that can exist right now and can be an excellent option for those who integrate these values into their lives.

Humanity is obliged to become more sustainable if it does not want to destroy the only planet it lives on and to stop climate change.

Socially responsible investing can be a very consistent way to affirm these values. It implies departing from the standard and, as we have already seen, at times being above and at other times below the main indexes.

Is inbestMe committed to socially responsible indices?

We insist that the main criterion for deciding to invest with our SRI portfolios, or in sustainability in general, should not be the search for better profitability, but to be aligned with our values or beliefs in this matter.

Being sustainable, even with indexes, implies some deviation from the main indexes.

If we prefer to be with the usual, standard indexing is still an excellent way to invest.

Remember that if you want to further customize your portfolio, you can contact cs@inbestMe.com. This is possible at inbestMe from €100,000/$ and taking our SRI portfolios as a starting point.

Appendix: main characteristics of the funds mentioned