Table of contents

ToggleThe fastest rises in history

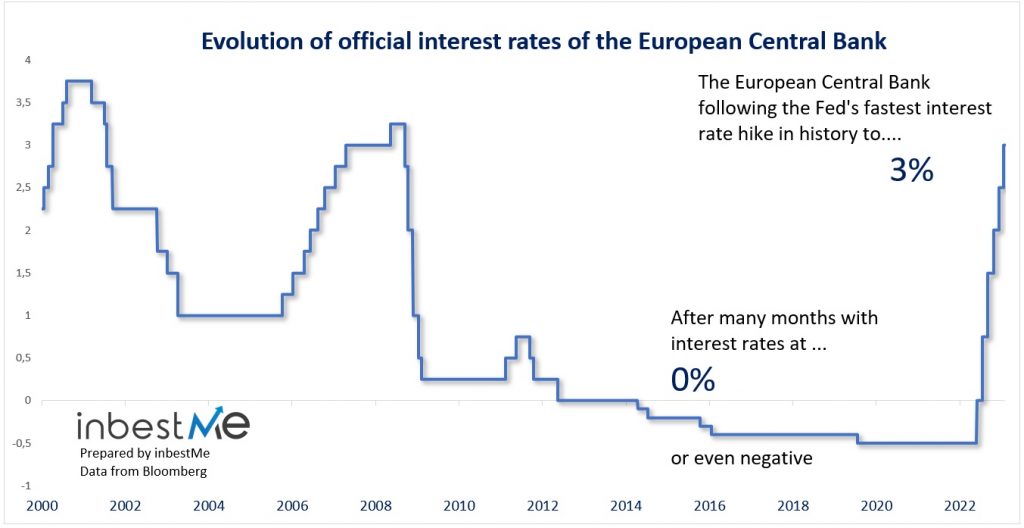

During the last few months, we have witnessed one of the quickest increase in official interest rates ever (in particular, we refer to the European Central Bank (ECB) and the US Federal Reserve (FED)).

Why do central Banks hike interest rates?

Interest rates can be thought as the cost of money. The control of the cost of money is the main tool that central banks use to attain their objectives.

ECB has only one objective, which is the stability of prices. The long term target is a 2% annual increase, which is considered physiological for an economy.

FED, besides the 2% long term inflation objective, also has a maximum employment objective.

Level of interest rates decided by Central Banks has a series of effects on the economy that should ultimately influence the level of prices. The process through which decisions of the Central Banks influence the level of prices is called monetary policy transmission.

There are basically 3 stages in the monetary policy transmission process:

- First one is given by the impact of monetary policy decisions on financing and spending decisions

- The second is the effect of financial conditions on aggregate demand

- The third is the effect of changes in aggregate demand on inflation

So, the reason Central Banks hiked aggressively interest rates was because of the sudden increase in inflation witnessed after the pandemic. Higher interest rates are expected to slow down demand and to slow down the economy. This should also decrease the upward pressure on prices.

The transmission channels

Let’s see briefly, what are the channels through which higher rates affect the economy. Let’s consider the effect on individuals first and the effect of firms afterward.

An increase in interest rates changes the incentives to save and spend for individuals. Suppose for example that the interest rate is zero, as it was the case until a few months ago. There is not much incentive to save, as the remuneration from savings is very low. Let’s suppose now that you can gain a 20% per year by investing. Certainly, the incentive to forego spending now and to save and invest changes radically.

Secondly, the level of interest rates influence the value of other assets. When interest rates are low, the value of other assets such as houses or stocks tends to be higher. So, when rates decrease, individuals get a bit richer, and they presumably tend to spend more. On the contrary, when interest rates are hiked they get a bit poorer, and they are likely to restrain their expenditures.

Also, when interest rates are higher, individuals are likely to spend more in payments such as mortgages for example and this leaves them less money in the pocket to spend on consumption, and viceversa.

As you can see, the effect of higher interest rates on individuals is likely to be a reduction in their demand for goods and services that tend to contain the increase in prices.

Let’s take a look at companies now. An increase in interest rates increase their financing costs. This makes them less willing to embark in new investments and reduces their profits. This slows down the economic growth and is likely to produce a higher unemployment as companies cut staff of the basis of a lower profitability and growth. A higher number of unemployed individuals greatly reduces their capacity to spend.

One last transmission channel of interest rates to prices is the exchange rate. Usually money tends to flow where it is better remunerated so higher interest rates usually also mean a stronger currency and a stronger currency means that imported goods are cheaper, a viceversa. So, higher interest rates tend to contain imported inflation by increasing the value of the domestic currency.

These are the main channels through which the effect of a change in interest rates flows in the economy and affects the level of prices.

Does it work?

Well, not perfectly, but it is anyway the main tool that central banks have. One thing that can be said is that increasing interest rates has some relevant costs in terms of higher unemployment and slower economic growth.

But are these costs worth in order to contain inflation? As we outlined above, the mechanism through which a change in interest rate impacts the level of prices is by managing the aggregate level of demand. Higher interest rates slow down demand and this reduces the upward pressure on prices.

This works quite well when the inflation is caused by an excess of demand. There are anyway cases in which inflation is not cause by an excess of demand but by higher costs. Let’s think for example of the increase in energy costs in Europe last year. The cause of inflation was not an increase in demand, but rather an increase in the cost of energy products.

In that case, slowing down the economy has not a big effect on costs, but it could add problems in terms of unemployment and push the economy in recession without affecting too much the real cause of inflation.

If we look at the graph below we see that the European inflation is much more caused by an increase in food and energy prices than in the US in which the increase is at the moment more caused by the services component.

European inflation is much more a cost inflation, while US inflation is much more a demand inflation. So, in Europe, the use of interest rates to slow down this kind of inflation risks to be quite an imprecise tool.

In a next post, we will analyze other tools of monetary policy that central banks have used during the last few years besides interest rates and that are usually defined as “non-conventional”.

Artículos relacionados:

Russia – Ukraine conflict: first news

Russia – Ukraine conflict: first news

Russia’s conflict: Exposure of inbestMe portfolios

Russia’s conflict: Exposure of inbestMe portfolios

Savings Portfolio yields (variable) rise to 1.90% in € and 4.00% in $

Savings Portfolio yields (variable) rise to 1.90% in € and 4.00% in $

What is going on with US banks?

What is going on with US banks?

The Federal Reserve raises interest rates by 0.25% and the yield of our Savings Portfolio also increase to 4.30%

The Federal Reserve raises interest rates by 0.25% and the yield of our Savings Portfolio also increase to 4.30%