We are extremely saddened to see war once again, this time more closely and on European soil, and hope for an early resolution to Russia’s conflict.

The inbestMe investment committee is following the situation in Ukraine very closely and considering the implications for our portfolios.

In relation to these events, we would like to clarify the exposure of our portfolios to the countries involved in the Russia’s conflict.

Before going into detail. It is worth remembering that our portfolios are globally diversified and therefore do not have any specific or concentrated risk in Russia or Ukraine.

These countries were part of some indices we use, especially emerging market indices. But their weight has always been quite limited and the direct impact on portfolio performance is negligible.

The major index providers are in the process of excluding Russia from their main indexes. So, the exposure in our portfolios will automatically be reduced to zero.

The exclusion is because Russian assets are no longer de facto investable, so the index cannot be replicated. Of course, the most affected will be the indices that only invest in Russia (which inbestMe does not use). The other indices will be affected only by the weight of Russia within the index.

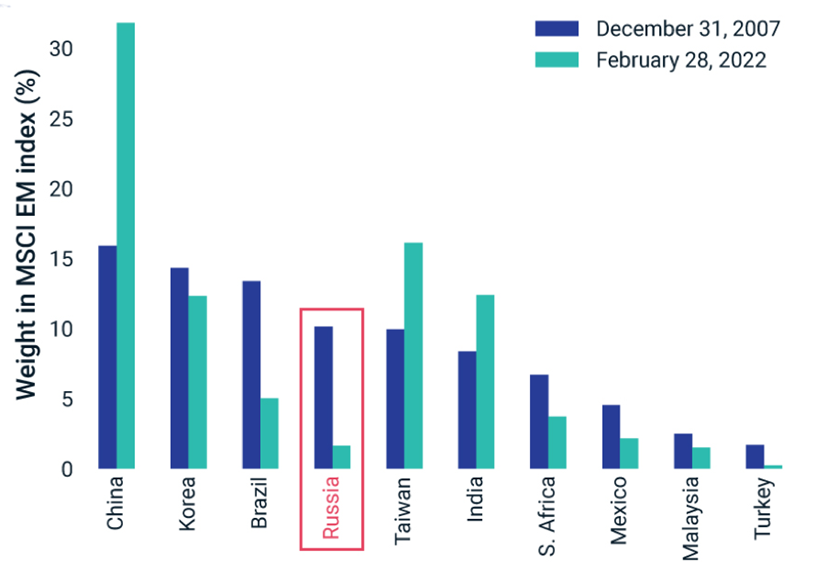

Consider, for example, emerging market stock indices, which are indices in which we do invest. Russia’s weight in the MSCI Emerging Markets index has progressively declined since the global financial crisis of 2008. At that time, Russia accounted for around 10% of the index. At the beginning of this year, it represented less than 4% of the index. Meanwhile, other countries such as China, Taiwan, and India have increased their weight in the index. This can be seen in the graph below:

Following the start of the conflict in February, Russia’s weight in the index has been falling steadily, approaching zero, meaning that the impact of losses on Russian assets are already discounted to current market prices.

The weight of Russia in the bond indices is around 0.70-0.80%, the weight of Ukraine around 0.90%

At the time of writing this article, the weight of Russia in the emerging market indices we use was between 0% and 0.25% for both conventional and SRI indices.

The maximum weight of emerging market stock indices in our portfolios does not exceed 11%. Therefore, the maximum weighted weight in equities is 0.03%.

The total weight of emerging market bond indices in our portfolios does not exceed 10%. Therefore, the maximum weighted weight in fixed income is 0.16%.

We see accordingly that, overall, the weight in our portfolios of the countries involved in the conflict is negligible, and the impact is already almost entirely reflected in current valuations.

Moreover, The complete removal of Russian assets from the major indices in the coming days will completely exclude any direct effect of the sanctions on Russia from our portfolios.

Of course, portfolios may still be indirectly impacted by the conflict, but this episode only newly emphasizes the importance of global diversification and the importance of avoiding concentrated country and/or company risk.

We fully understand the anguish that some of our clients may feel as their portfolios lose value in the short term: it is natural, on the one hand, it is normal for emotions to run high, it is important to remember that following a medium to long term investment plan is, in most cases, is the safest option.

In this sense, it may be useful to review why it is necessary to continue investing when markets fall and why it is a mistake to stop investing in times of uncertainty.