During the night of 23-24 February 2022, Russia attacked Ukraine, triggering the Russia-Ukraine conflict. The worst-case scenario has come true. The attack comes after separatist leaders of Ukraine’s eastern republics asked Putin for military assistance. Ukraine, for its part, had said it had no intention of invading the separatist regions.

Putin, in a televised speech in the evening, accused the West of ignoring the assurances that Russia asked for and of overstepping the red line of NATO’s eastward expansion. Russia’s goal would be to “demilitarize Ukraine.” According to this approach, missile strikes would target the Ukrainian military.

The Russian defence minister has denied indiscriminate attacks on civilians by stating that the targets are military infrastructure and air forces that are attacked with “high-precision weapons.” Russian troops also landed in the Black Sea port cities of Odessa and Mariupol. Ukrainian President Zelensky has asked his Security and Defence Council to declare martial law.

Table of contents

ToggleWhat about financial markets?

As far as financial markets are concerned, the Russian stock market has fallen sharply, almost 50% at one point before recovering some ground. In recent hours, the rouble has even traded above one hundred roubles to the euro. In recent years, the rouble has steadily lost ground against the euro and the dollar. Just a year ago, it was trading at around sixty roubles per euro. Of course, there are many elements to consider and any assessment at this stage could be premature.

By this morning, the Western response is expected, which so far has been inadequate and lacking in unity. Initial comments from Western leaders so far are sparse. Europe, which is already amid an energy crisis, has now a problem with establishing strong sanctions because it depends on gas from Russia.

Crucial in this context is the position of China, which has stayed on the sidelines so as not to damage relations with Europe too much, but is on Russia’s side and has accused the United States of fuelling tensions. In recent days, Beijing has come out against sanctions against Russia.

Russia-Ukraine conflict: implications

It is exceedingly difficult to assess all the implications without knowing the scope of this war. We can, however, glimpse the first short-term consequences. This situation could have repercussions on inflation. Commodity indices are higher this morning. Indeed, on the one hand, Ukraine is a major producer of agricultural products, while Russia is a producer of energy products. Of course, the markets will immediately start to assess how to fit the war situation with the other big issue, the already announced monetary tightening that central banks will start shortly.

There are two opposing forces at work here:

- On the one hand, large-scale military confrontation could be a reason for caution for central banks

- On the other hand, this could lead to higher inflationary pressures through higher energy prices.

Therefore, it is not easy to see the implication of all this on central bank reactions, as the situation is still unfolding.

Caution will prevail with monetary tightening measures.

War and stock markets during the Russia – Ukraine conflict

As always, we advise our clients to stay on the course that they have set and not to worry about the headlines. Our portfolios are designed to go through these extreme events as well. Making decisions in the heat of the moment and getting carried away by emotions is the worst option in these cases and can be detrimental to achieving long-term goals. Recently, we already wrote about why to stay invested when markets fall. Today it is more difficult to say it again, but no less valid.

History shows us that the relationship between war and financial markets is contradictory. Some say that the growth of modern financial markets is a consequence of war. Whenever countries have had to raise huge sums of money to finance battle, this has stimulated the development of the great financial centers so that they could sell war bonds at astronomical interest rates.

What happened to other similar situations?

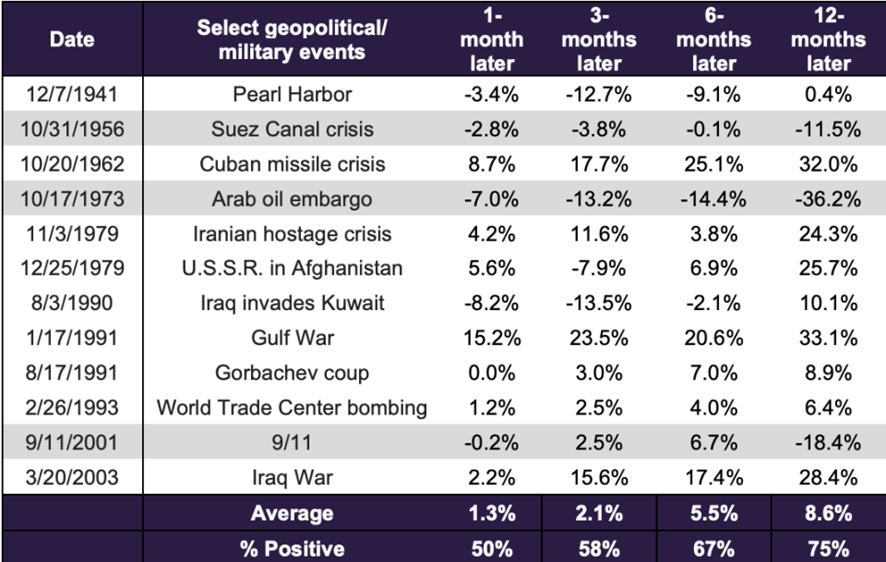

As a guideline (but bearing in mind that history is never the same) we include a table with the market behaviour in previous war episodes compared to the Russia-Ukraine conflict.

You can find for yourself many other tables that are circulating these days about major events, including wars and markets: you will see that they all agree on one thing, after a few months the situation is positive.

Without going any further, one could argue that just two years ago we went through an extremely complex situation, such as the COVID-19 health crisis. Some compare it to a global war caused by a virus.

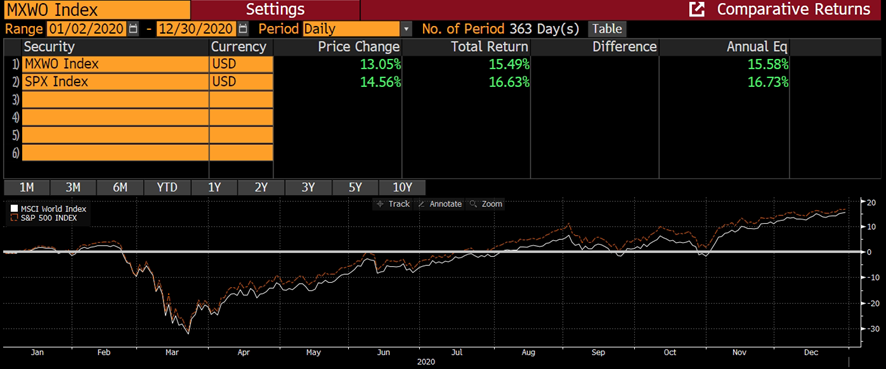

Looking again at the graph of the performance of the main indexes for that same year will help us to remember that we will also come out of this situation.

During 2020, both the MSCI World and the S&P500 fell by just over 30% to end the year with a gain of around 15%. This is the nature of stock markets. In the short term they have a volatile nature especially in the face of unforeseen situations, in the long term they have a natural upward trend.

The world, over time, will continue to improve, grow, and become a better and more efficient place to live than it was before, despite this war. We trust that this assumption remains valid. If it turns out to be incorrect, we have much more to worry about than the value of our portfolios.

Artículos relacionados:

Russia’s conflict: Exposure of inbestMe portfolios

Russia’s conflict: Exposure of inbestMe portfolios

Savings Portfolio yields (variable) rise to 1.90% in € and 4.00% in $

Savings Portfolio yields (variable) rise to 1.90% in € and 4.00% in $

What is going on with US banks?

What is going on with US banks?

The Federal Reserve raises interest rates by 0.25% and the yield of our Savings Portfolio also increase to 4.30%

The Federal Reserve raises interest rates by 0.25% and the yield of our Savings Portfolio also increase to 4.30%

Financial assets during the economic cycle

Financial assets during the economic cycle