Index funds and ETFs have made it easier to access almost any asset class, and gold is no exception. But do you know how to invest in gold in 2022?

Buying gold bullion is an option, but it can be inefficient, especially if we are looking for flexibility in our investments.

We have options to have exposure to gold without having to physically buy bullion.

This is not the first time we have talked about gold.

We did so in mid-2019 to echo because many preferred to invest in gold. And a year later, to explain why gold kept going up in mid-2020.

In this post, we are going to focus on analysing what are the best options for investing in gold in 2022. As an alternative to buying bullion.

Table of contents

ToggleInvest in gold in 2022 with ETCs

The sad news is that there are no index funds or ETF available that track the price of gold.

The diversification principles of the regulatory framework for investment funds (UCITS) do not allow funds to be launched under these regulations with a single component, which is the case when we are talking about gold.

Normally, an investment fund or ETF is made up of different assets that allow the diversification rules to be met (be they multiply stocks, bonds, commodities, etc.)

Because of this, gold is not available in mutual fund or ETF format.

But the good news is that there are alternatives.

It is because of the above that investment in gold, without having to invest in bullion, is only available as an exchange-traded product in ETC format in European countries.

Let us remember that an ETC is an Exchange Traded Commodity, or a certificate issued by a financial institution and, in this case, is guaranteed with physical gold.

What are the best ETCs to invest in gold in 2022?

Today there is a very extensive offer of ETCs.

There are more than 25 ETCs that track the price of gold. Discriminating which ones are the best is not an easy task.

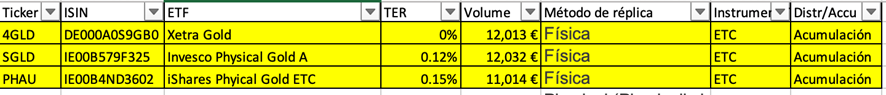

In the following table we have summarized the ones that seem to us to be the best.

To make this selection, we have considered several aspects.

Volume:

In the table above we see how these three ETCs exceed ten billion Euros and clearly stand out from those that follow them closely which are around five billion Euros.

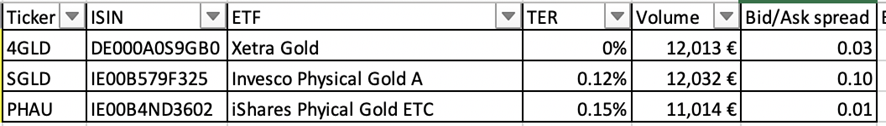

Volume is important because it also conditions liquidity and spread (difference between bid and ask price).

Spreads:

A listed product, be it a stock, a bond, has an “ask price” that can be considered the price at which it is offered and a “bid price” or the price the buyers are demanding.

To make a simile with the real estate sector, it is the same thing that happens between the price at which the owner wants to sell (ask price or the price at which the offer is usually higher) and the price at which the buyer wants to buy (bid price or the price at which the demand is usually lower).

The interaction between the two results in the final price at which a trade is crossed.

The narrower the spread between the two, the more efficient the asset is. This is normally linked to the managed volume of the asset and the volume traded daily.

As we can see in the table below, the tightest spreads of the ETCs considered are those of iShares Physical Gold ETC (0.01) and Xetra Gold (0.03).

Type of replication:

In this case this factor is truly relevant.

We are more interested than ever that the replication method is physical, i.e., that the value of the ETC is supported by physical gold.

As we can see, all 3 ETCs are backed by physical gold. All the ETCs we are aware of are physical replication, therefore, it is not a differentiating factor in making the selection of the best ones.

Although we do not believe it is the ultimate goal of most investors, for example, we can see here how to exercise our right to physical delivery of Xetra Gold gold in certain circumstances.

Manager/entity:

Considering that they are ETCs it is especially important that the entities that give us the guarantees of the certificates are solid.

Both Xetra, Invesco and iShares seem to us to be sufficiently solid entities.

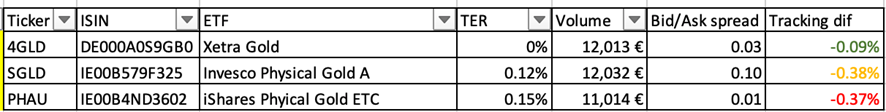

Tracking difference:

The “Tracking difference” or tracking difference is the discrepancy between the performance of the vehicle (index fund, ETF or ETC in this case) and the performance of the index.

The best by far is the Xetra Gold, with a tracking difference of 0.09%.

They are followed in that order by Inverco’s with tracking differences of 0.38% for Invesco’s and 0.37% for iShares as shown in the table below:

TER:

The TER (Total Expense Ratio) is the cost passed on by the manager to manage the ETC. The lower the TER, the less difference is subtracted from the performance of the underlying.

Although the TER gives us an indication of the internal costs borne by an ETF, we already saw in another post that the tracking difference gives us a more complete idea of all the internal costs borne by the ETF.

In this case we see that there is even an ETC, that of Xetra Gold with TER of 0%[1] . The other two alternative ETCs also have very tight TERs, 0.12% (the one from Inverco) and 0.15% (the one from iShares).

These lower TERs allow us to slightly reduce the cost of this part of the portfolio by 2022.

[1]We have investigated in detail and this ETC does bear costs of 0.025% per month as custody fee and that are not reported as TER. Even so, we have already seen that this is the ETC with the best tracking difference.

Accumulation is better than distribution:

Finally, it is always better to invest in accumulation products, as we avoid possible withholding taxes on dividends. Although it is true that we can reinvest them later, it is always better that the same vehicle automatically reinvests the dividend.

In this case, this factor is not relevant since gold does not produce dividends or yields (precisely one of the criticisms of gold) and all ETCs are accumulation ETCs.

Portfolios to invest in gold in 2022

As we have already mentioned, due to its characteristics there are no index funds and, therefore, our index fund portfolios cannot include this asset.

Consequently, at inbestMe we only include gold investment in ETF portfolios.

There are many discussions about whether it is convenient to have gold in a portfolio and whether it brings additional diversification.

There are also those who think that Bitcoin is the new digital gold and that this will be the new asset class alternative and uncorrelated to bonds and stocks.

“This is a topic that we already discussed at some length here and in summary we said that “although we on the investment committee are not big fans of investing in gold, we believe that, in the current uncharted economic situation, where yields are negative and the money printing machines are running relentlessly, diversification with gold makes a lot of sense.

In this context, gold will certainly be a risk-reducing asset and possibly also a yield-enhancing asset.”

In any case gold is an asset class that has an exceptionally low or even negative correlation (depending on the period) with stocks and bonds and is therefore an asset class that helps diversify a portfolio.

This is something that is clearly intuited in the chart below.

Other data extracted from the graph

We can also see from the chart that although gold does not earn interest or a dividend, it has had an APR of 8.5% in Euros or 8.3% in dollars since 2001.

To put these returns in context, gold’s APRs are two percentage points higher than what the MSCI World has yielded in Euros (7%) and dollars (6.8%) respectively over the same period.

However, these returns are for the last 20 years and, as can be seen in the graph, they are concentrated in specific periods, undoubtedly in many cases the most volatile.

In this case, the rule applies more than ever, that past performance does not guarantee future performance.

The profitability of gold in dollars over the exceedingly long term (since 1900) is more moderate, below 4%. It is especially since 2000 that this return has accelerated. Gold played a key role in the 2008 financial crisis.

We take this opportunity to remind you that we allocate up to 8% of our Standard ETF portfolios to gold and can tactically increase/reduce this exposure in the Dynamic portfolios.

As a result of the analysis associated with this post, on how to invest in gold in 2022, we are going to change the priorities of the ETCs to use in our Euro ETF portfolios according to the table we have been sharing in this post.

This allows us to slightly reduce the TER of this component of the portfolio, by fifteen basis points (0.15%), and of the portfolios in total, by around one basis point (0.01%).

The reduction in terms of tracking difference is around three basis points (0.03%).

This change will be made gradually, starting in February 2022, taking advantage of the rebalancing of our clients’ portfolios and as always at no additional cost.