9th World Wonder or the most powerful force in the universe

This is how Albert Einstein defined the compound interest formula.

In the photo attached right below (that has been manipulated) we see him explaining one of the formula’s derivations. The powerful force that according to the interest rate makes it possible for an investment to double in just a few years.

Let’s take for example the average annual compound return of S&P 500’s that is approximately 9%.

72 / interest rate (%) = num. years for your money to double!

72/9 = 8 years

After 8 years an investor will have doubled the initial investment if the money is deposited in S&P 500 and, of course, if we assume that the compound annual growth is an average of 9%. That is the magic formula.

If we go over the formula’s construction we will understand what is going on and why.

This powerful force emerges from the exponential growth of capital caused by the reinvestment of the investment’s returns. Consequently, the returns become multiplicative according to the formula:

Initial Capital (1 + i) ^ n = Final Capital

i = interest rate or return n = the number of years

In another article published by Inbestme “Trees and compound interest” there is detailed information about this formula.

Following the previous example we can see that:

(1 + 9%) ^ 8 = 2, proves again that an investor can double the capital invested after 8 years (the same as a 100% of gain.)

However, Inbestme’s intention in this post is to emphasize how this force remains so powerful with time. We can see this in the following charts.

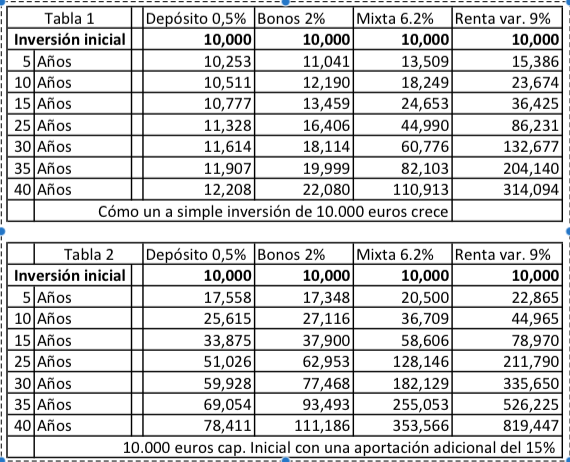

Here are two assumptions concerning part of Inbestme’s services. How does an initial 10,000 € investment evolve over the years (Chart 1). Nowadays, with so low interest rates, a deposit is not really an option to get returns out of your savings and fixed income isn’t either. As seen in the chart, an investor that is ready to accept the rules of equity (including the implicit volatility that goes with it) will earn in the next 40 years a 314,000 € capital (duplicating in the first 8 years the initial amount invested). The same example but with a mixed profile is also reflected in the chart. In this case, an investor can get a reasonable revaluation of 110,000 €.

Table 2 shows a much more attractive approach. It shows the result of investing an additional amount of 1.500 € per year. In this case, the amount of returns obtained turn out to be more than acceptable to get out of an investment successfully. An investor with a mixed or “balanced” profile (60% variable income, 40% fixed income) could accumulate thanks to “the force” an amount exceeding 350,000 €. Meanwhile, an investor with an aggressive profile (100% variable income) could earn more than 800.000 €. A private investor that is able to beat the market with only an annual +0.65% could get 1M € (this is our goal for customised portfolios).

To invest an additional amount every year offers a huge advantage. We will invest the money in different market moments to guarantee additional returns and significantly reduce risk.

However, this powerful force can also affect the dark side of investments, costs.

Let’s imagine that an investment service costs an additional 2% over another service. This extra cost is the result of combining: the financial advisor’s commission, the transaction’s cost and funds implicit costs (not very relevant). In other words, this 2% would be accumulative as well and it would suppose about 50.000 € of our profits.

At the end, the powerful force affects returns as much as it affects costs and it manifests itself like an accumulative process along the time. Investment related costs have to be one of the investor’s priorities in the decision-making process.

After all, the “force” is predominantly a temporary force related to time. You just have to take a look at the impact of waiting 10 years to start investing. If we compare the figures earned after 30 and 40 years that appear in each of the table’s columns, we can see how a “balanced” investor can achieve the same capital as an aggressive investor by starting to invest 10 years before (with probably smoother investments).

If your needs and financial objectives are clear and you are willing to take your first steps in the world of investments, choosing one of our diversified portfolios is an excellent way to start. Inbestme combines optimal portfolios with ETF’s from different asset classes and markets. You can now become a successful investor starting at 10,000 €.

Know your investment profile and begin investing with us as soon as possible. Time and discipline are the best allies for any investor.